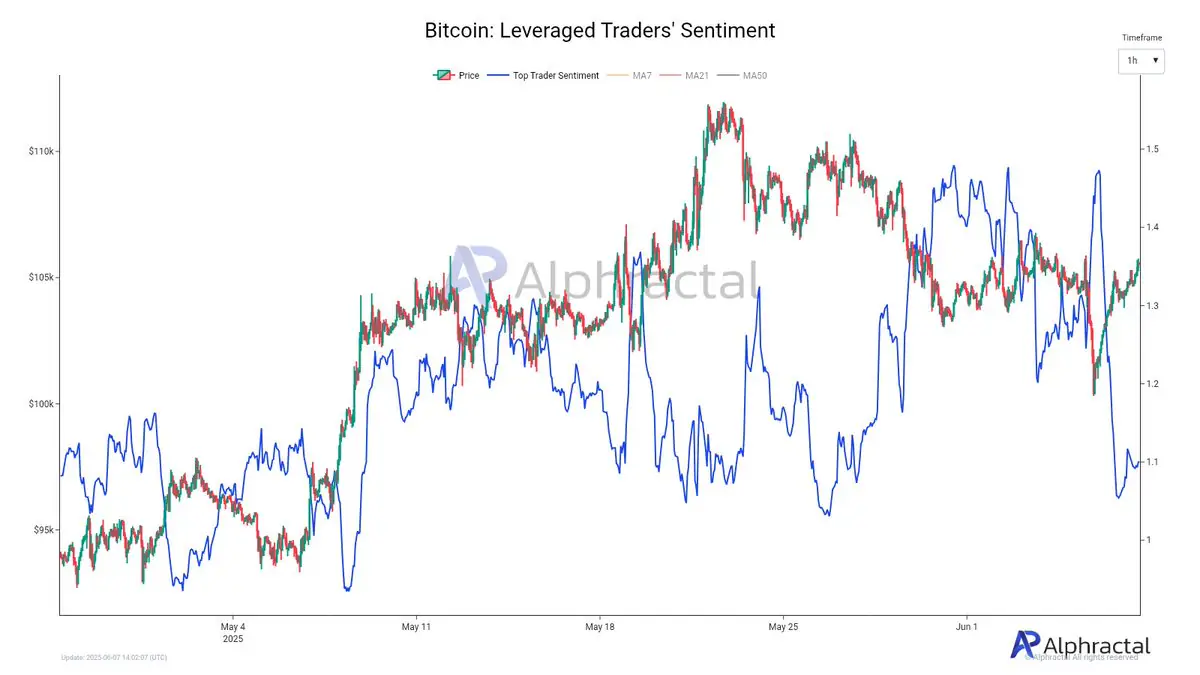

According to data from Alphractal, retail traders are piling into short positions, betting on a decline just as BTC climbs above the $105K zone.

The firm’s Leveraged Traders’ Sentiment indicator shows a sharp rise in short interest, particularly among smaller market participants.

Historically, when retail traders become heavily bearish, the market often does the opposite—and that dynamic appears to be in play now.

What Is Leveraged Traders’ Sentiment?

Alphractal’s metric blends three core components to capture the mood of the market:

Long/Short Ratio by Position Size Long/Short Ratio by Trader Accounts Funding Rate behavior across exchangesThese elements are normalized and weighted, offering a more accurate view of how leveraged players are positioned. When this sentiment becomes extremely one-sided, it often signals a potential reversal or continuation in the opposite direction.

“The market tends to move where the majority least expects,” Alphractal noted. “Right now, that’s higher.”

Contrarian Setup Could Keep Fueling Upside

The sentiment chart shows rising bearish bets despite Bitcoin’s steady ascent throughout May and into early June. This divergence between price action and retail positioning increases the likelihood of a short squeeze or continuation of the uptrend.

With top traders staying neutral or long while retail leans short, this setup fits the classic contrarian rally structure—a pattern where traders betting against the trend become fuel for its continuation.

The post Bitcoin Rally Fueled by Bearish Bets from Retail Traders appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·