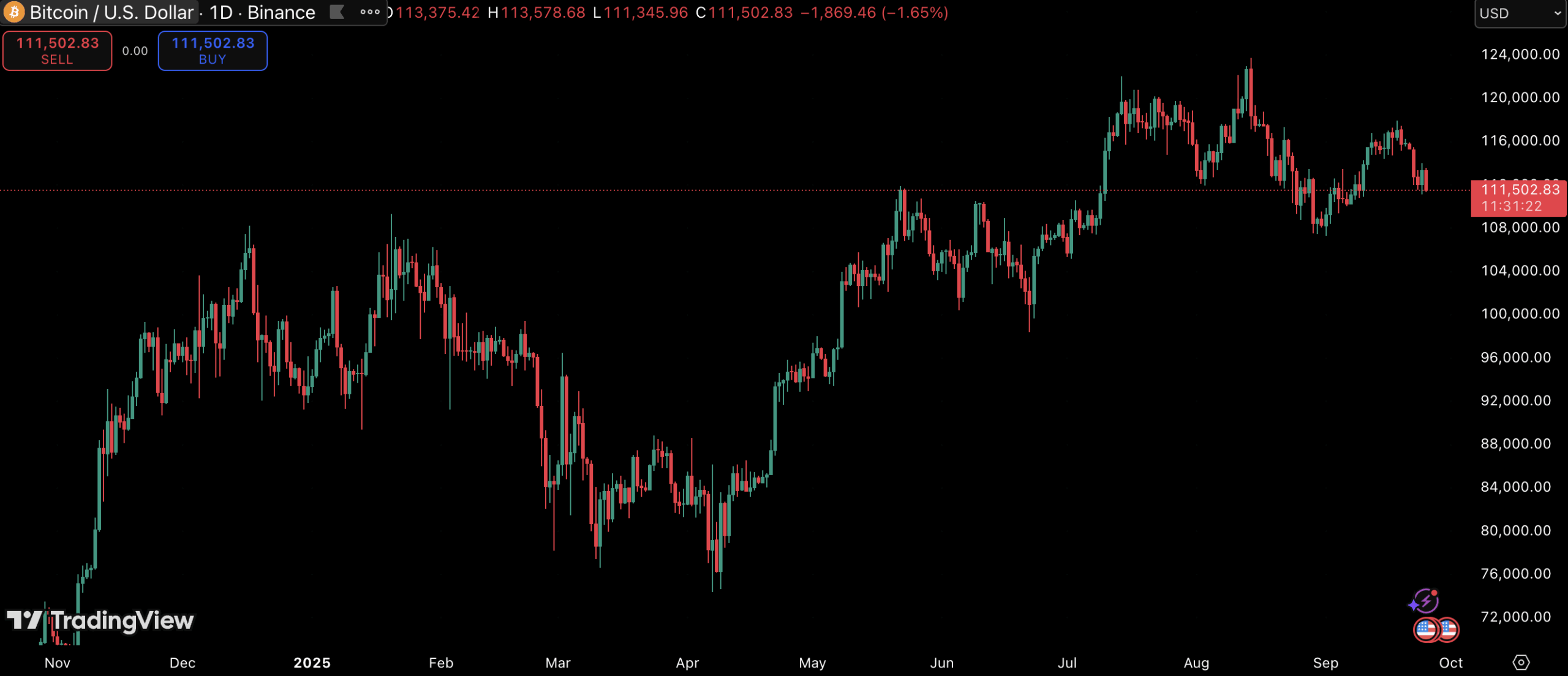

The level is drawing heightened attention from traders as analysts point out that holding above $111,100 could set the stage for a major breakout.

Market analyst Ali Martinez suggested that Bitcoin’s current structure may be forming the right shoulder of an inverse head-and-shoulders pattern.

If the $111,100 support remains intact, the setup could pave the way for a rally toward $130,000 in the coming weeks.

Other analysts also see history potentially repeating. Crypto Rover compared today’s market to September 2024, when Bitcoin experienced a brief deviation below support before surging into a massive Q4 rally.

Rover believes a similar “Q4 pump” could soon send prices significantly higher.

Technical charts reinforce the bullish case. Bitcoin’s recent pullback has brought it back into a key support zone, aligning with the neckline of an inverted head-and-shoulders formation. If this structure confirms, it would add weight to the bullish forecasts pointing to a breakout.

Still, the stakes remain high. A decisive drop below $111,000 could invalidate the bullish pattern and open the door to further downside.

For now, traders are watching closely to see if Bitcoin can hold this line and build momentum for another strong fourth quarter run.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Bitcoin Price: Q4 Pump Setup Resembles 2024 Rally Pattern appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·