Tapiero points out that forward inflation expectations have plunged dramatically, a shift that may force the Federal Reserve’s hand sooner than markets expect. Even if the Fed remains officially “data dependent,” the real conditions on the ground — as Tapiero stresses — are “clear as day.”

With real interest rates already considered too restrictive against the backdrop of ongoing fiscal tightening, Tapiero anticipates a liquidity spigot reopening. In such an environment, risk assets like Bitcoin, gold, and tech stocks (NDX) stand to benefit, while the U.S. dollar could face renewed pressure.

Bitcoin Price Target: 180,000 Within 12 Months

Most notably, Tapiero makes a bold prediction: BTC could reach $180,000 within the next 12 months.

This projection hinges on the idea that, as liquidity returns to markets and restrictive monetary policy unwinds, capital will flood back into hard assets and alternative stores of value — with Bitcoin poised to be a major beneficiary.

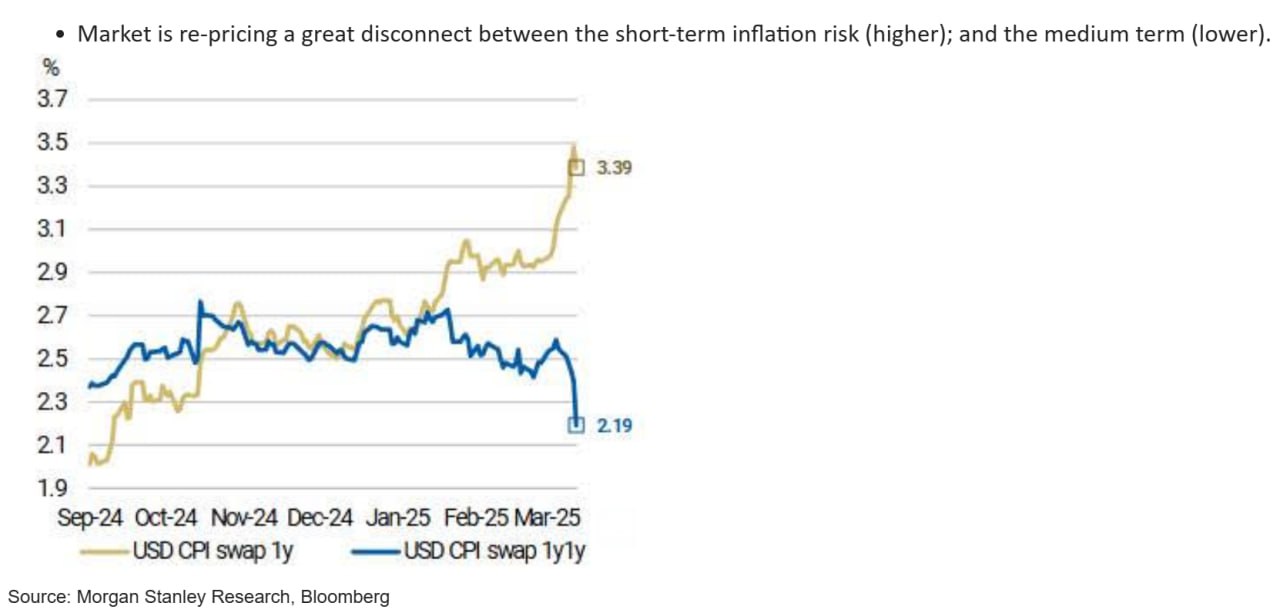

The charts Tapiero shared show a sharp disconnect between short-term inflation risks and longer-term market-implied inflation expectations, highlighting the unusual and extreme pressures currently brewing beneath the surface of financial markets.

Outlook: Macro Tailwinds Are Building for Bitcoin

If Tapiero’s thesis plays out, Bitcoin could be on the verge of a major expansion cycle driven not just by crypto-native dynamics, but by a broad macroeconomic shift — one that sees liquidity flooding back into the system after a prolonged tightening phase.

With inflation expectations falling, real rates staying high, and financial stability concerns rising, Bitcoin’s role as a neutral, hard-capped asset looks more critical than ever.

The message is clear: capital is preparing to move — and Bitcoin could be one of the biggest winners.

The post Bitcoin Price Prediction by Dan Tapiero appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·