Bitcoin’s latest run topped out at $111.8K, pushing just beyond January’s high before pulling back to $103.2K. The move suggests momentum may be cooling after a strong multi-week climb.

Instead of breaking out further, BTC paused. Traders now watch to see if this dip leads to consolidation or a deeper reset.

Spot Buyers Took the Lead on This Leg Up

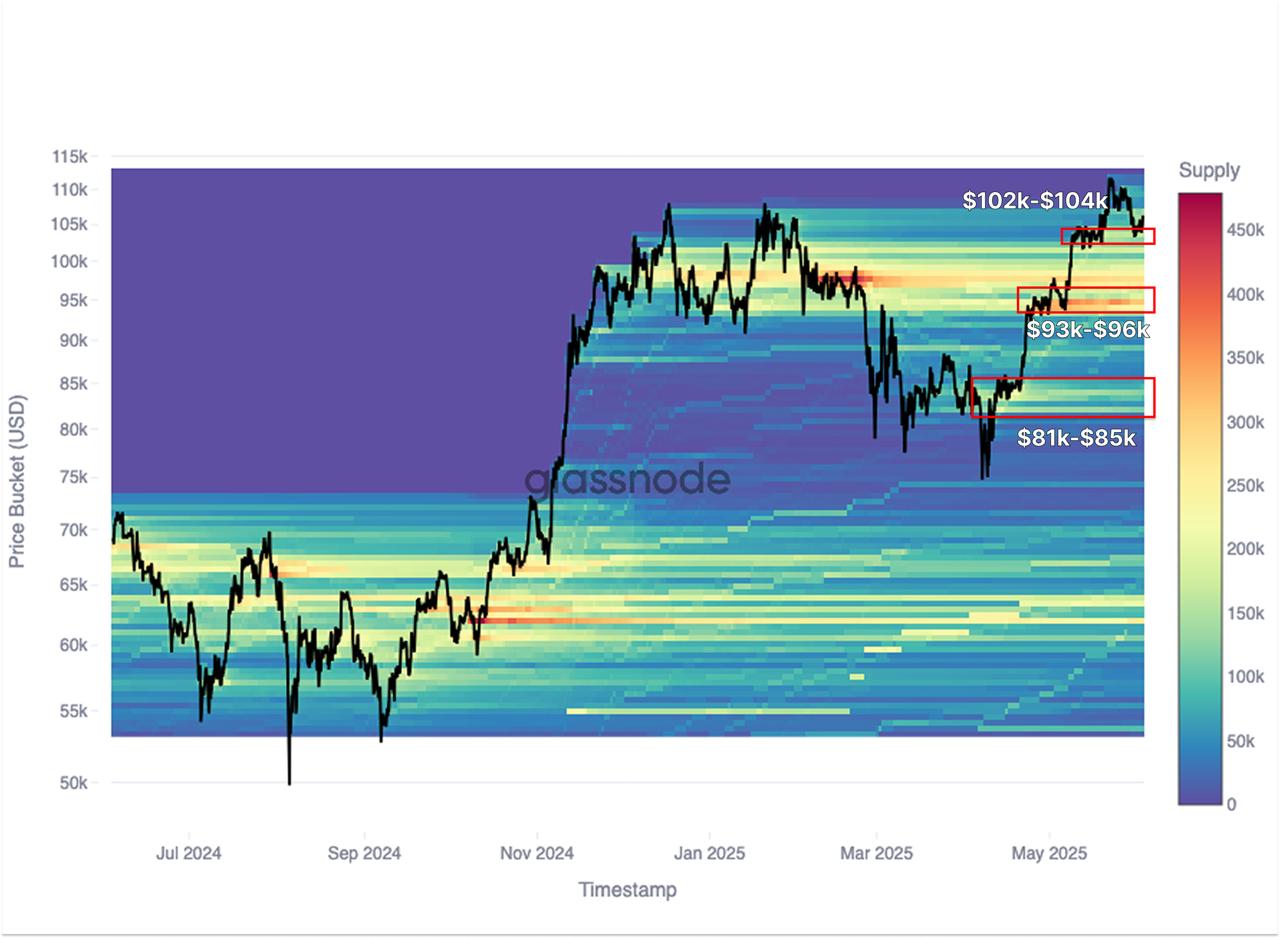

According to Glassnode, this rally wasn’t driven by hype or derivatives. It was spot buying—measured through the Cumulative Volume Delta (CBD) Heatmap—that led the charge.

That heatmap tracks aggressive buys and sells across price levels. It reveals where bulls stepped in most forcefully.

Three price zones show heavy accumulation:

$81K–$85K $93K–$96K $102K–$104KThese ranges now double as potential support zones, packed with buyers who may defend their entries.

Early Buyers Face a New Test

Holders from early 2025 who stuck around during the dip below $80K are now feeling pressure again. With BTC chopping near $103K, their next move could shape short-term market direction.

Do they hold and absorb more supply—or take profits and reset the structure?

What Comes Next?

Support between $93K and $104K needs to hold if bulls want another push higher. A breakdown could open the door to a retrace toward the $90K region.

The stair-step pattern from earlier this year shows strong structure—but that structure needs defending.

According to Glassnode report, momentum may return, but for now, the market waits.

The post Bitcoin Price Correction Tests Key Support Zones After Rally appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·