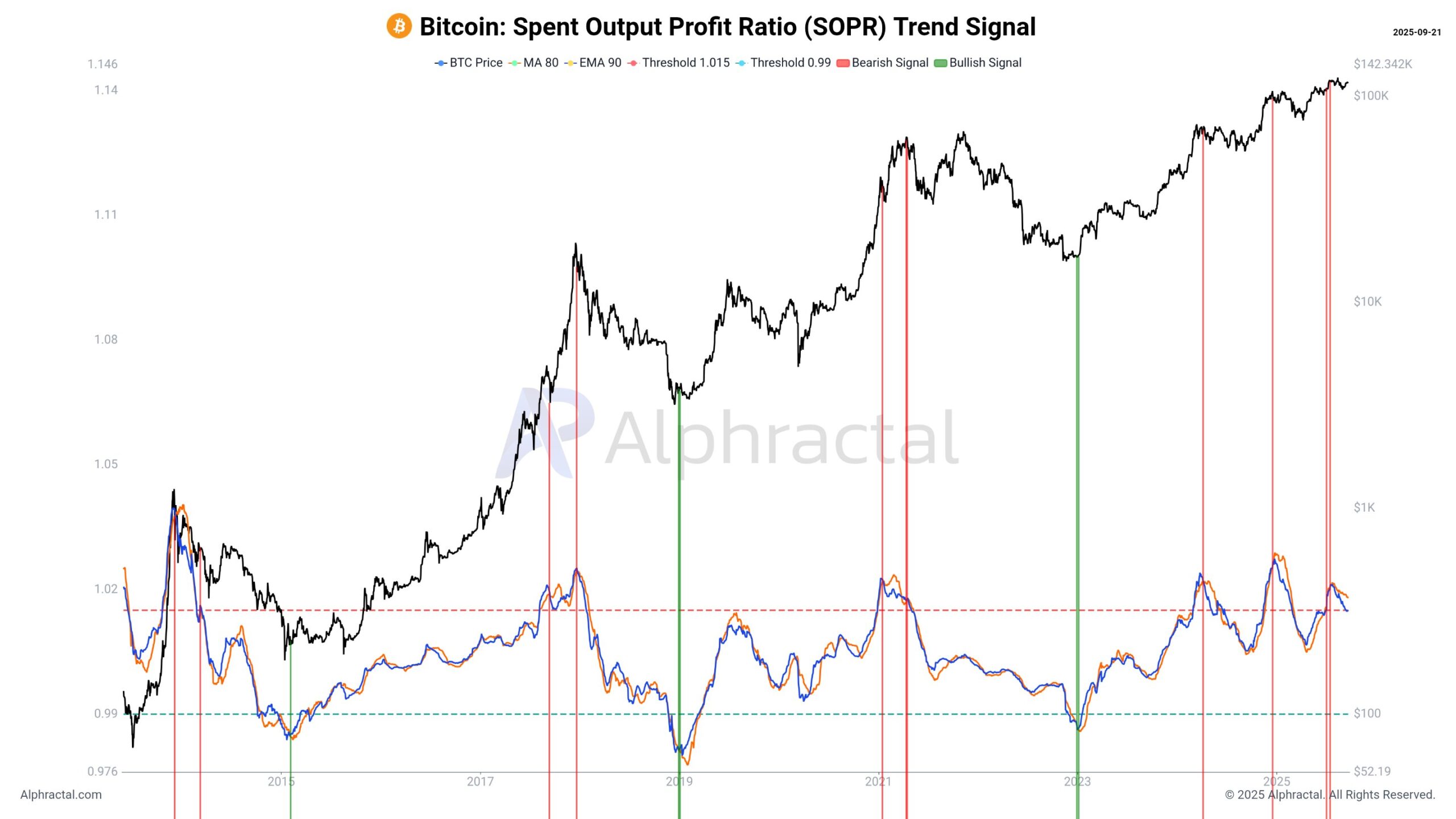

Analyst Joao Wedson, CEO of research firm Alphractal, pointed to three warning signs that suggest Bitcoin’s latest rally is losing steam. The first involves the Spent Output Profit Ratio (SOPR), a key on-chain gauge of whether coins are being sold at a profit or a loss.

While the SOPR still sits above the breakeven level of 1, Wedson noted that it has begun trending lower. That downshift implies that sellers are pocketing less from their transactions, signaling that profitability is shrinking even as prices remain high.

Pressure From Short-Term Holders

Wedson also highlighted the realized price for short-term holders, currently hovering near $111,400. With Bitcoin trading so close to this level, any slip beneath it could unleash a wave of stop-loss selling, further amplifying downside momentum.

Risk-Reward Looks Less Attractive

Finally, Wedson argued that the current cycle lacks the same risk-adjusted payoff that past bull runs offered. Despite Bitcoin’s higher headline price, the Sharpe ratio – a measure of return relative to risk – has weakened. That suggests investors face more volatility with less potential reward compared to earlier cycles.

Altcoins Waiting in the Wings

Taken together, these factors point to an exhausted cycle, according to Wedson. He added that market enthusiasm could soon pivot away from Bitcoin itself and into altcoins, where traders may see greater opportunities for fresh upside.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

The post Bitcoin Price: 3 Bearish Signals Point to Deeper Drop appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·