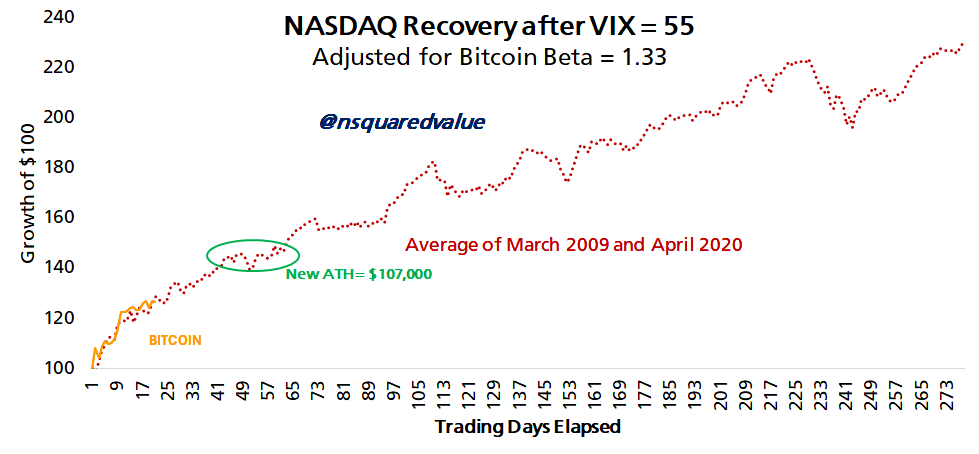

Peterson’s chart draws a comparison between post-crisis NASDAQ recoveries (specifically March 2009 and April 2020) and Bitcoin’s recent price action.

When adjusted for Bitcoin’s higher volatility (beta = 1.33), the projection aligns Bitcoin’s current path with a rapid upside trajectory.

“Bitcoin is mirroring the NASDAQ’s recovery after the VIX hit 55,” Peterson notes — pointing to a period of historical bullishness that followed extreme market fear.

The orange line on the chart represents Bitcoin’s current performance, plotted against the NASDAQ’s past post-crisis trends.

If the pattern continues, the $107,000 target could be reached within roughly 50–70 trading days from the start of this rally — which aligns with a mid-to-late June window.

The post Bitcoin on Track for New All-Time High Within 3–6 Weeks, Says Analyst appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·