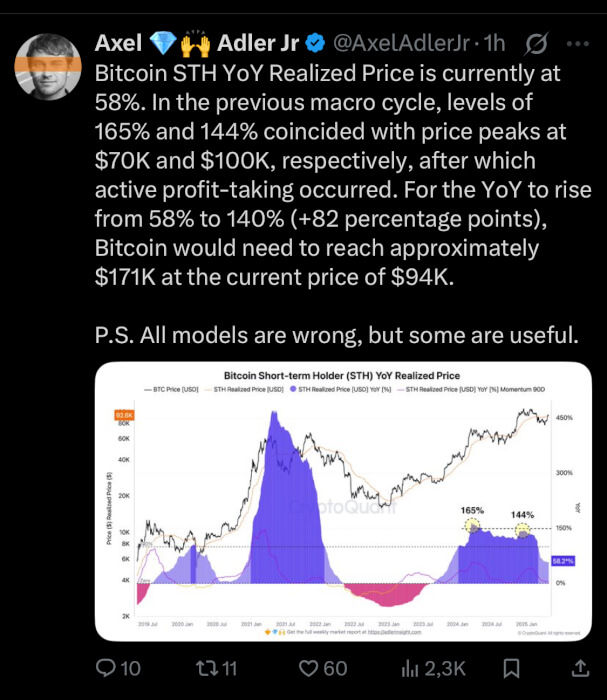

In previous macro cycles, this metric peaked at much higher levels—165% and 144%—which coincided with Bitcoin reaching $70K and $100K, respectively. These surges were typically followed by waves of profit-taking.

To mirror those historical highs in the current cycle, the YoY Realized Price would need to climb by 82 percentage points, hitting 140%.

At the current Bitcoin price of approximately $94K, this implies a potential top around $171K.

Adler adds a reminder: “All models are wrong, but some are useful,” underscoring that while historical data can offer guidance, it’s not a guarantee of future performance.

The post Bitcoin Needs to Hit $171,000 for Realized Price Model to Match Previous Cycle Peaks appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·