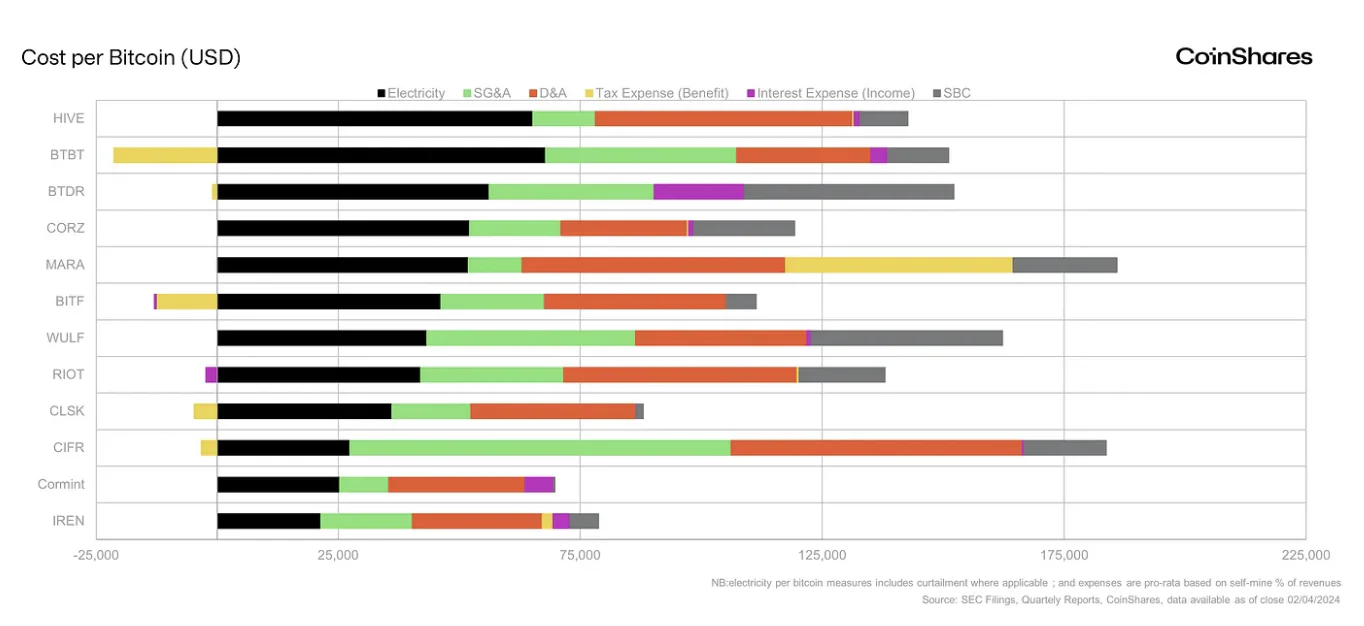

Publicly listed miners faced an average production cost of $82,162 per Bitcoin, marking a sharp 47% increase compared to the previous quarter.

CoinShares identified several reasons for the surge, including accelerated hardware deployments, higher tax burdens, and an uptick in non-cash expenses like depreciation and stock-based compensation.

When excluding Hut 8 Mining — which faced significant tax expenses — the average cash production cost among public miners stood at $75,767. Factoring in non-cash items pushed the total average production cost to a steep $137,018 per Bitcoin.

Tax Expenses and Hardware Turnover Fuel Rising Costs

The report highlighted that faster hardware turnover and fierce competition among miners contributed to rising operational costs. At the same time, fluctuating Bitcoin prices and compressed valuation multiples made profitability even harder to maintain.

CoinShares pointed to Hut 8 as an extreme example. The company recorded the highest unit cost among all surveyed miners, driven by a $93 million deferred tax liability and elevated interest payments from convertible notes and credit facilities. As a result, Hut 8’s total cost per mined Bitcoin skyrocketed to over $281,000 during the quarter.

READ MORE:

Bitcoin Price Prediction From 21Shares

Miners Focus on Efficiency Gains

Despite mounting costs, many mining firms are working to improve operational efficiency. Companies continue to invest in next-generation mining equipment and explore cost-cutting strategies to remain competitive in a tightening market.

As Bitcoin’s price edges higher, miners hope that improved efficiency and a favorable market environment will help offset soaring production expenses in the quarters ahead.

The post Bitcoin Mining Costs Surge to New Highs in Late 2024, Says CoinShares appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·