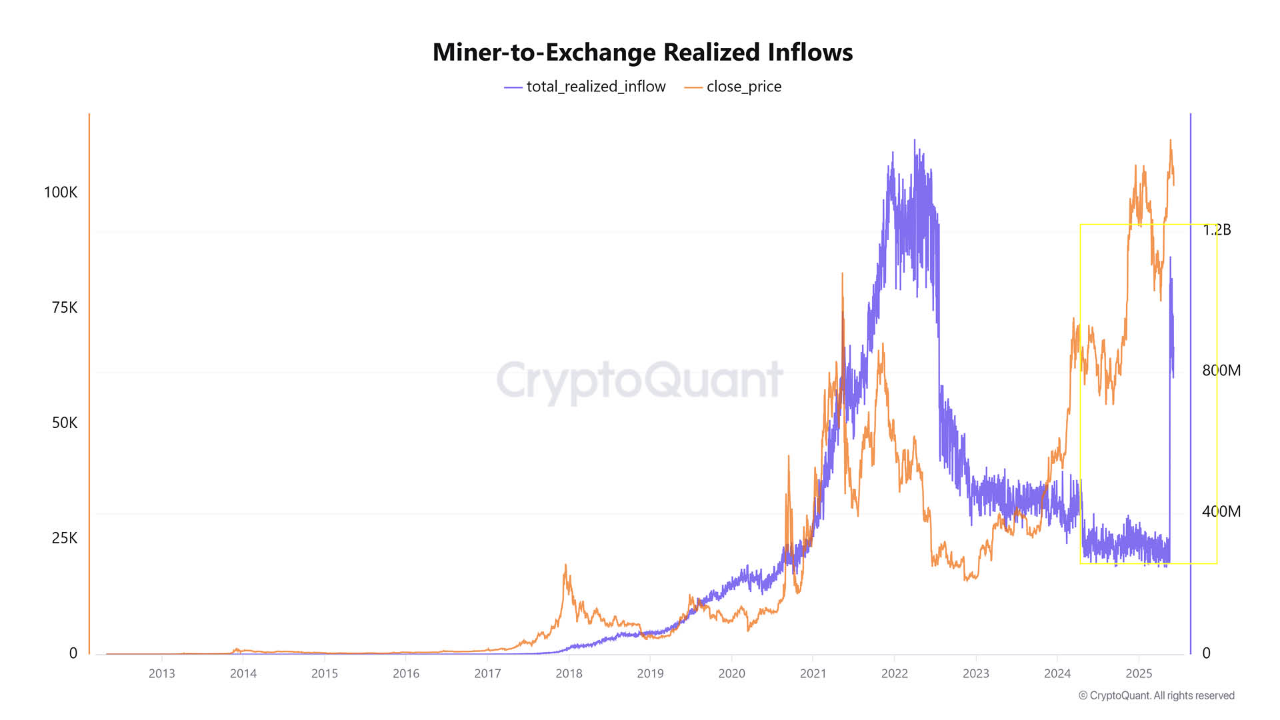

A dramatic spike in Bitcoin miner-to-exchange inflows has emerged, signaling a potential wave of sell pressure from the mining sector. According to data from CryptoQuant, realized miner inflows to exchanges surpassed $1 billion per day between May 19 and May 28, 2025, marking one of the highest surges on record.

The timing of this activity aligns with a cooldown in BTC’s price, suggesting miners may be preparing to liquidate portions of their holdings—typically a bearish indicator for short-term price action.

What Miner Inflows Reveal

When miners transfer coins to exchanges in large volumes, it often reflects intent to sell, which can flood the market with supply and increase volatility. These movements serve as a critical sentiment gauge, given miners are a dominant source of spot BTC liquidity.

As CryptoOnchain notes, “Such sharp inflows generally indicate a stronger willingness to liquidate, often preceding corrections or increasing pressure on price stability.”

Why It Matters

Miner behavior is a key leading indicator for traders and investors. Spikes like this should be watched closely, especially during consolidation periods. This kind of inflow activity historically coincides with either a local top or structural shift in market sentiment.

As BTC prices hover near resistance, continued miner selling could weigh on upside potential unless demand from buyers can absorb the added supply.

The post Bitcoin Miner Exchange Inflows Soar Past $1B Daily, Signaling Major Sell Pressure appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·