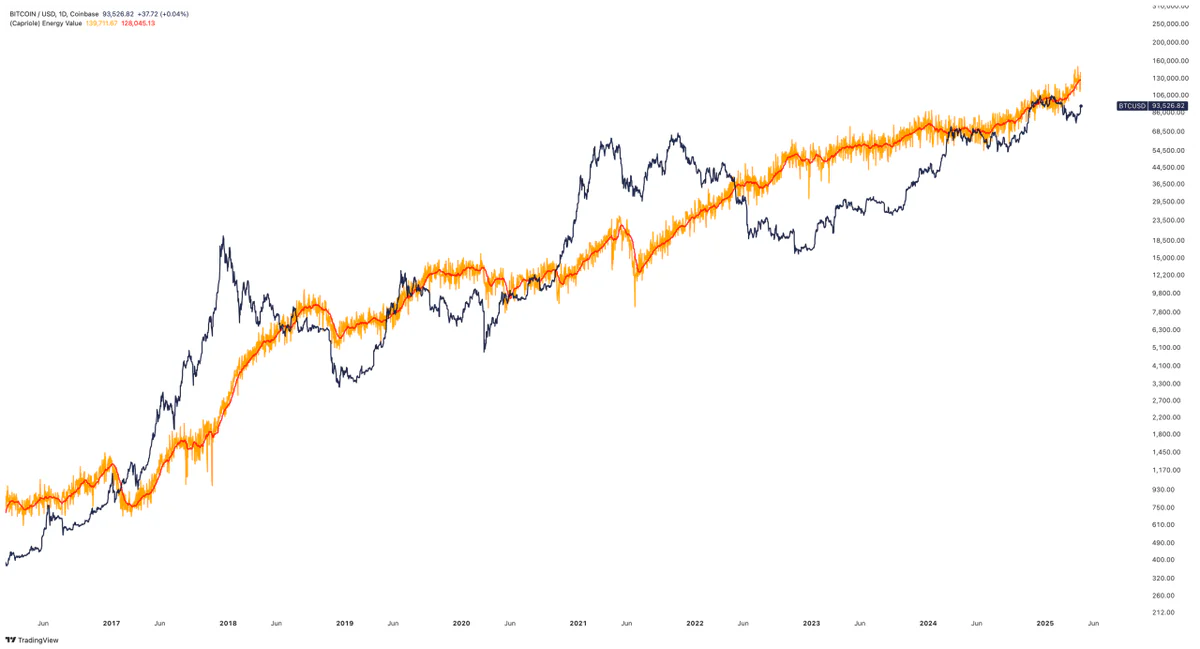

In a recent analysis shared on social media, Edwards highlighted that his proprietary Bitcoin Energy Value model currently estimates BTC’s intrinsic worth at $130,000.

That’s roughly 40% higher than Bitcoin’s current market price, which sits around $94,000.

Energy Value Model: Powering Bitcoin Valuation

The Bitcoin Energy Value model, created by Edwards, uses the total energy consumption of the BTC mining network to estimate BTC’s fundamental value. It operates under the assumption that the amount of energy (measured in joules) used to secure the network can serve as a pricing foundation.

This model aligns Bitcoin’s economic value with its physical cost of production, drawing from energy-based economic theories.

Undervalued or Ready to Catch Up?

If the model holds true, BTC may still have significant room to grow. A 40% undervaluation could be a bullish signal, particularly for long-term investors looking for entries during consolidation periods.

While no valuation model offers guarantees, the energy-based approach provides a data-backed lens into Bitcoin’s potential price floor—especially as mining costs rise and institutional interest grows.

Whether Bitcoin closes this valuation gap remains to be seen, but Edwards’ analysis adds further weight to the argument that BTC’s fundamentals may still be outpacing its current price.

The post Bitcoin May Be 40% Undervalued Based on This Model appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·