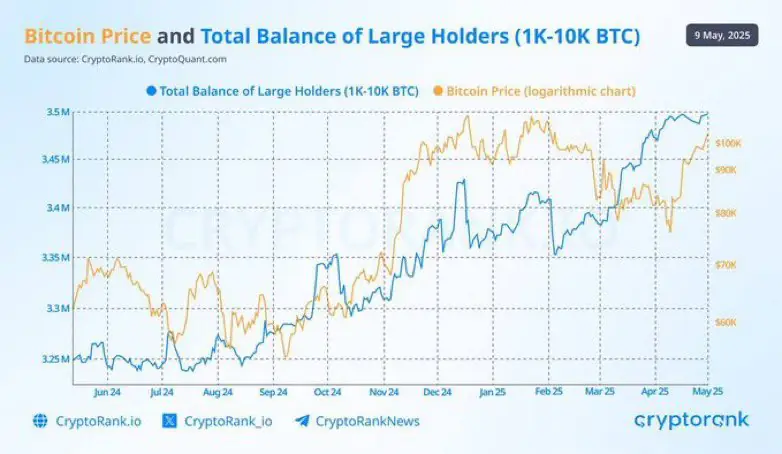

According to the latest chart published by CryptoRank and sourced from CryptoQuant, this cohort has increased its total holdings by over 200,000 BTC since early 2024.

Smart Money is Accumulating

The chart highlights a sharp uptick in the total balance of large holders, now reaching above 3.45 million BTC. This steady rise began around October 2024, closely aligning with the upward trend in Bitcoin’s price — a pattern often interpreted as a sign of smart money accumulation.

Historically, increased holdings by large wallet addresses are seen as a bullish signal, as these entities tend to be institutional or long-term investors who accumulate strategically during low-volatility or consolidation phases.

Price Surge Supported by Whale Confidence

Bitcoin’s price, shown on the logarithmic scale, has followed a similar trajectory to the large holder accumulation curve. While brief corrections occurred along the way — such as the March 2025 dip — the correlation suggests that whale buying has helped reinforce bullish momentum.

This dynamic reinforces recent on-chain trends showing:

98% of BTC holders are currently in profit

Low exchange inflows, indicating coins are moving to cold storage

Low funding rates, meaning derivatives activity hasn’t yet overheated

The post Bitcoin Large Holders Accumulate Over 200,000 BTC as Price Climbs Past $100,000 appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·