After a period of consolidation, Woo highlights that capital inflows into the Bitcoin network are ramping up again. Both total flows and speculative flows have bottomed and are now aligning, a dynamic that typically fuels a bullish environment backed by fundamentals. The long-term outlook appears increasingly constructive, supported by improving liquidity and favorable on-chain trends.

At the same time, Bitcoin’s fundamentals have shown a major positive shift. If the current capital flow trend persists, Bitcoin is setting up for a potential break above previous highs. Woo describes the present market regime as a solid long-term setup, with dips seen as buying opportunities rather than warning signals.

Short-Term Friction Ahead, But Higher Targets Remain

In his latest analysis, Woo cautions that while the broader trend is upward, the immediate momentum may face some friction. Bitcoin’s on-chain VWAP (Volume-Weighted Average Price) is currently sitting at +3 standard deviations, suggesting a state of overextension.

This overbought condition implies that sideways action or, at best, a slow grind upwards is likely in the near term rather than a sharp breakout. Still, Woo emphasizes that the market’s underlying structure remains solidly bullish.

Higher Price Targets Come Into Focus

Medium-term price targets of $90,000 and $93,000 have already been met, according to Woo’s tracking. New interim targets around $103,000 are now forming, with the broader objective still set at $108,000.

Importantly, Woo notes that these targets are supported by underlying capital inflows and not just speculative trading, strengthening the case for durable upside.

Liquidity Returns, Downside Risks Muted

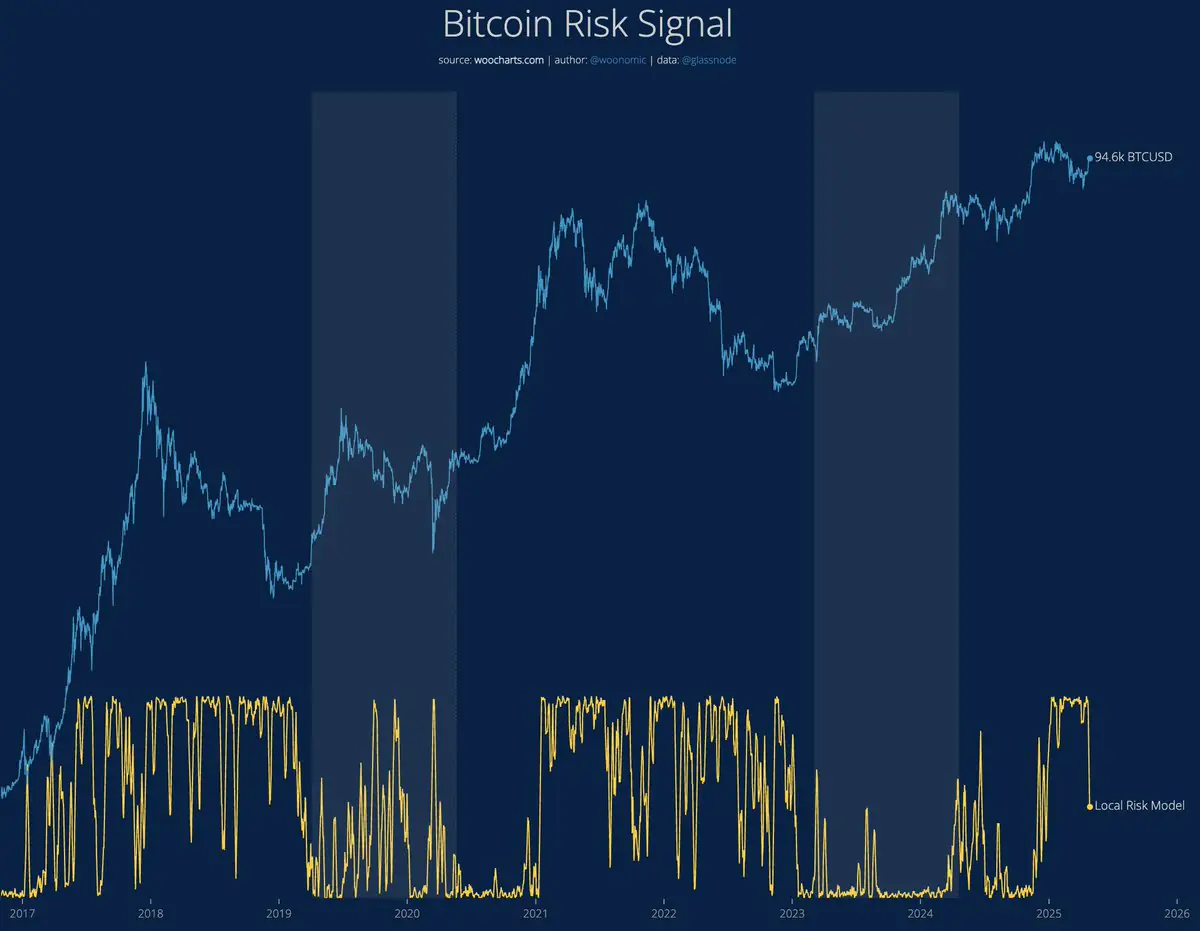

Woo’s analysis also highlights that liquidity has returned to the market. His risk model has started trending downward, a signal that financial conditions are easing and supporting further asset accumulation.

With stronger capital flows and improved liquidity, downside pullbacks are expected to be muted under the current environment.

Outlook: Willy Woo Sees Bullish Foundations Strengthening

Overall, Bitcoin’s backdrop is rapidly improving according to Willy Woo’s on-chain analysis. Fundamentals have turned decisively bullish, network activity is accelerating, and market liquidity is deepening.

While short-term consolidation may still occur, the broader setup points to continued expansion — and a real shot at pushing Bitcoin into new all-time highs over the coming months.

As Woo puts it, this is not a bad setup to break all-time highs.

The post Bitcoin Fundamentals Turn Bullish as Capital Flows Reignite, Says Analyst Willy Woo appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·