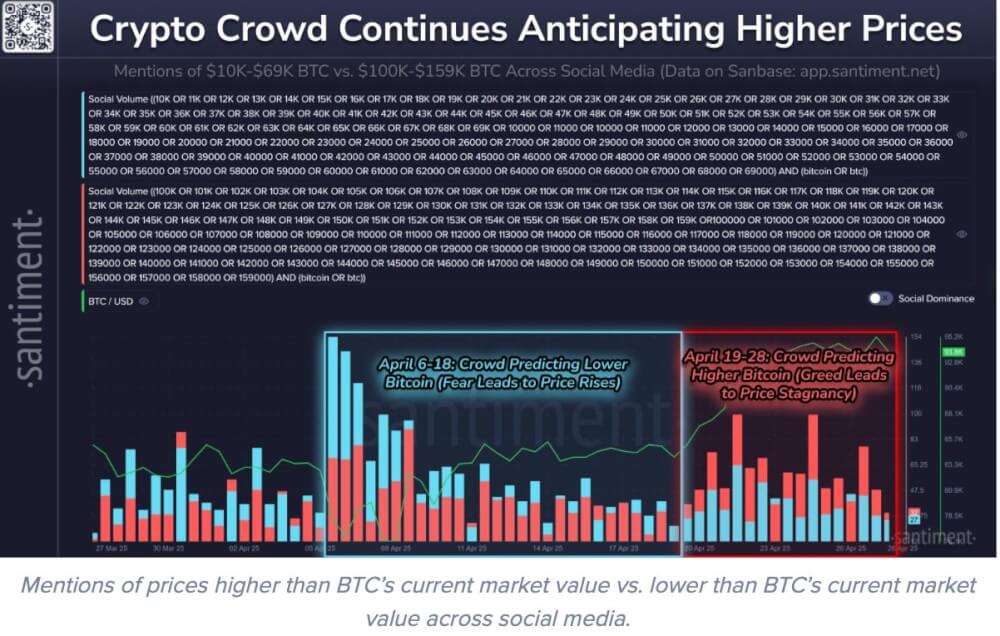

After a turbulent start to the month—fueled by trade tariffs and a concerning correlation with the declining S&P 500—retail traders began abandoning ship, expecting a deeper plunge. From April 6 to April 18, social media chatter was dominated by bearish price predictions ranging from $10K to $69K.

Ironically, according to Santiment, that pessimism marked the market’s prime buy opportunity.

Social Media Calls Flip Bullish

With BTC recovering steadily and market volatility settling, social sentiment has now swung to the other extreme. Current mentions of price targets between $100K–$159K vastly outnumber bearish calls, suggesting a renewed wave of retail FOMO.

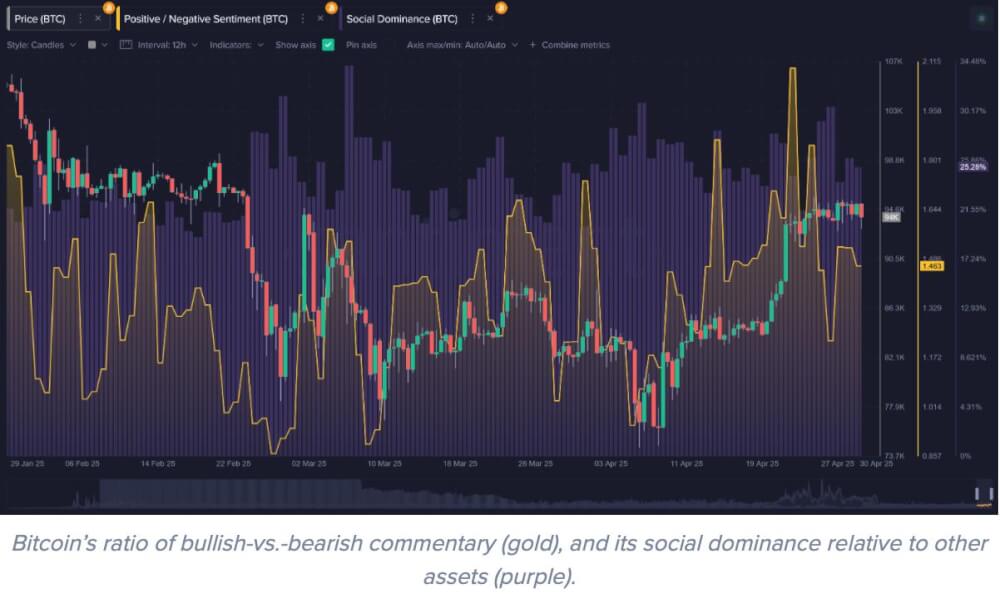

Data from Santiment shows that overall discussion volume for Bitcoin remains stable at 25% of all crypto chatter, but the ratio of positive-to-negative sentiment is now climbing sharply.

In the social metrics:

Gold line = Net bullish vs. bearish Bitcoin commentary Purple bars = Bitcoin’s social dominance among top 100 crypto assetsThese signals point toward a crowd once again believing in a rapid upside—often a red flag for seasoned traders watching for market tops formed by excessive optimism.

The post Bitcoin FOMO Fever Returns as $95K Breakout Sparks Bullish Buzz appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·