The massive wave of investment has reinvigorated optimism across the broader crypto market.

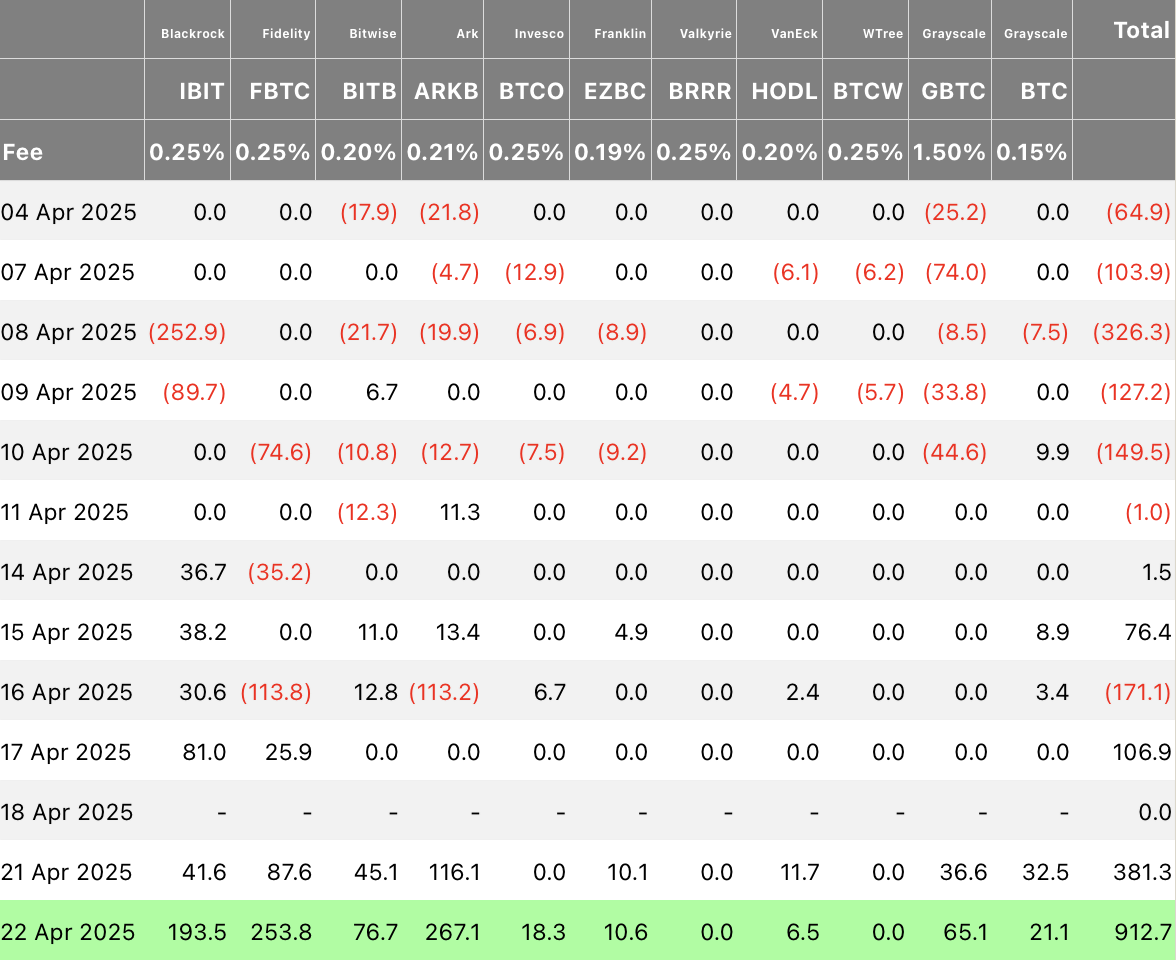

According to Farside Investors data, Bitcoin ETFs alone attracted $936.43 million in net inflows on the day, bringing the week’s total to $1.32 billion—an aggressive return of institutional capital to crypto products.

ARKB, FBTC, and IBIT Dominate the Flow Charts

ARK 21Shares’ Bitcoin ETF (ARKB) led the daily rankings with $267.1 million in inflows, pushing its total net inflows to $2.98 billion and net assets to $4.59 billion, placing it third in overall Bitcoin ETF assets. Fidelity’s Wise Origin Bitcoin Fund (FBTC) closely followed, adding $253.8 million. The fund now boasts $11.62 billion in total inflows and $18.16 billion in assets, solidifying its position as the second-largest U.S. spot Bitcoin ETF. BlackRock’s iShares Bitcoin Trust (IBIT) continued its dominance with $193.5 million in fresh inflows, lifting its cumulative net inflows to $39.99 billion and net assets to a staggering $52.7 billion, making it the clear market leader.Other notable gains include:

Bitwise Bitcoin ETF (BITB): $76.7 million daily inflows Grayscale Bitcoin Trust (GBTC): $65.1 million daily inflowsDespite recent inflows, GBTC remains the worst performer in terms of overall net flows, having shed $22.68 billion since its conversion to a spot ETF. Still, it ranks third in total assets under management (AUM), with $17.51 billion.

The post Bitcoin ETFs See Nearly $1 Billion in Daily Inflows, Largest Since Trump Took Office appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·