The spike in interest comes amid renewed momentum in the crypto markets, as Bitcoin hovers near all-time highs.

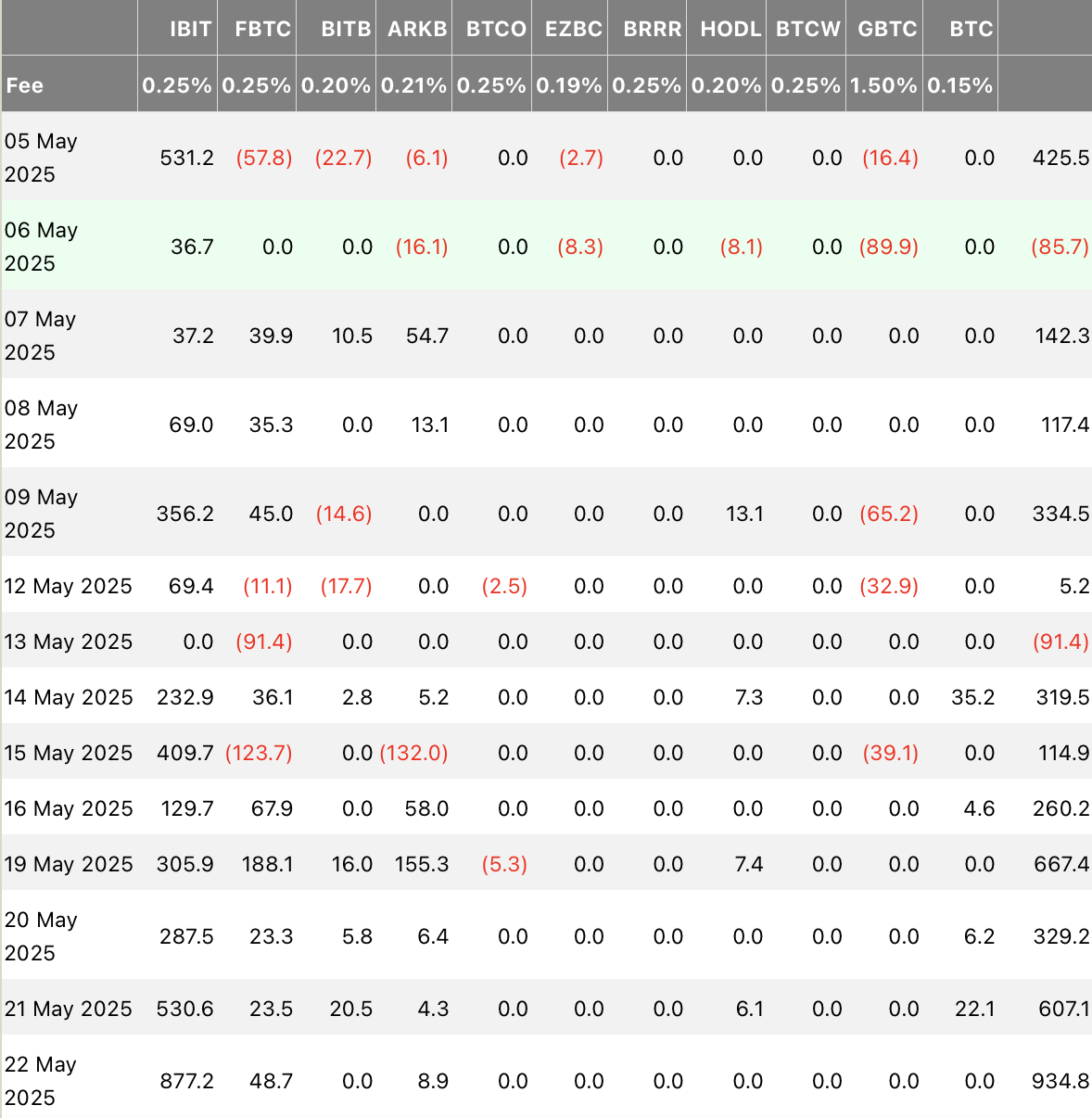

BlackRock’s iShares Bitcoin Trust (IBIT) led the surge, accounting for a massive $877.2 million of the total inflow—more than 93% of the day’s ETF volume. Fidelity’s FBTC followed with $48.7 million, while ARK Invest’s ARKB posted $8.9 million in new inflows. Other spot Bitcoin ETFs recorded no net inflows for the day.

The latest inflows have propelled IBIT to a new milestone. According to Bloomberg ETF analyst Eric Balchunas, the fund has gone “full Pac-Man” since April 22, absorbing more than $7.7 billion in that time. With assets under management now reaching $68.7 billion, IBIT is among the top five ETFs by year-to-date inflows across all asset classes.

“IBIT has gone full Pac-Man in the past month,” Balchunas wrote, referring to its aggressive dominance in the ETF inflow race.

The renewed investor demand signals growing institutional confidence in Bitcoin as an asset class, especially through regulated investment vehicles like ETFs. Analysts suggest this wave of inflows could fuel further upside in BTC’s price, echoing the rally seen earlier in the year following January’s record-breaking ETF activity.

As the crypto market matures, ETFs are rapidly becoming the preferred access point for both retail and institutional investors looking to gain exposure to Bitcoin with transparency and security.

The post Bitcoin ETFs See $934.8M Inflows, Led by BlackRock’s IBIT in Largest Day Since January Surge appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·