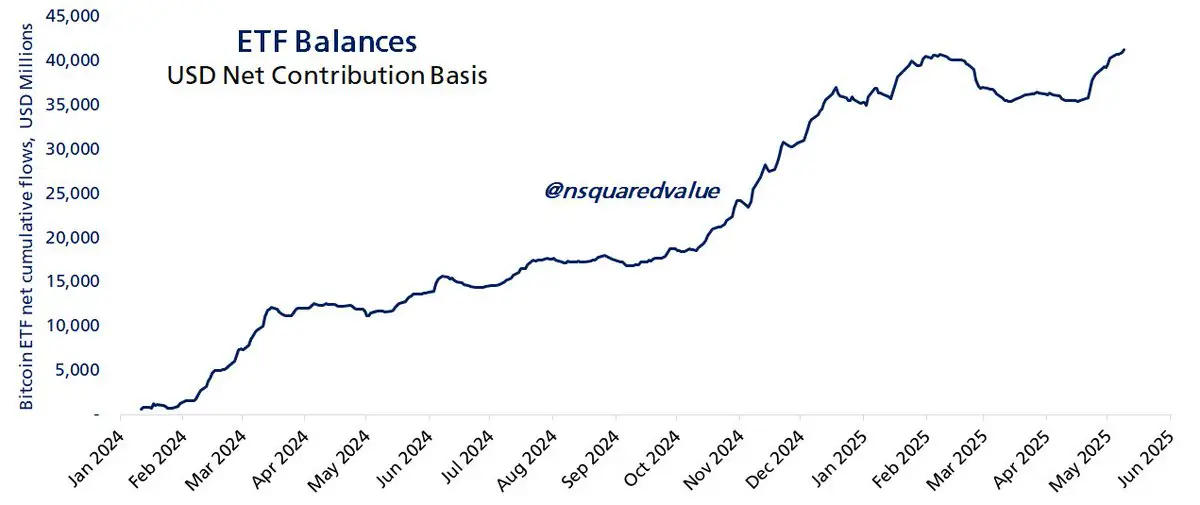

This milestone surpasses the previous record of $40.8 billion, set on February 7th of this year.

The explosive growth in flows underscores continued demand for Bitcoin from institutional and retail investors alike, despite ongoing concerns about global economic conditions.

ETFs Drive New Institutional Demand

The chart, posted by Peterson, illustrates the steady and nearly uninterrupted growth in net ETF contributions since their approval in early 2024. Even during periods of volatility, net inflows remained resilient, signaling long-term confidence in BTC as a financial asset.

As of now:

Net assets in Bitcoin ETFs total approximately $106 billion For context, U.S. Gold ETFs hold about $175 billion“Bitcoin has reached 60% of gold’s ETF size in just over a year,” noted Peterson. “An amazing feat by any standard, and evidence of genuine demand across diverse investor types.”

Outpacing Expectations Despite Economic Uncertainty

What makes the milestone particularly noteworthy is that it comes amid what Peterson describes as “economic hard times.” Even as broader markets have faced macro headwinds, Bitcoin ETFs continue to attract inflows, pushing net cumulative flows to new records and supporting the broader bull market structure.

This continued rise reflects:

Growing mainstream and institutional acceptance of Bitcoin The role of ETFs in offering a regulated, accessible vehicle for crypto exposure Strong correlation between ETF inflows and price appreciationLooking Ahead

With Bitcoin now trading above $103,000 and ETF participation at record levels, many analysts see this trend as far from over. If current momentum continues, Bitcoin ETF holdings could rival gold’s within the next year, fundamentally altering how traditional markets perceive the asset class.

The post Bitcoin ETF Flows Hit Record $41.3B, Now 60% the Size of Gold ETFs appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·