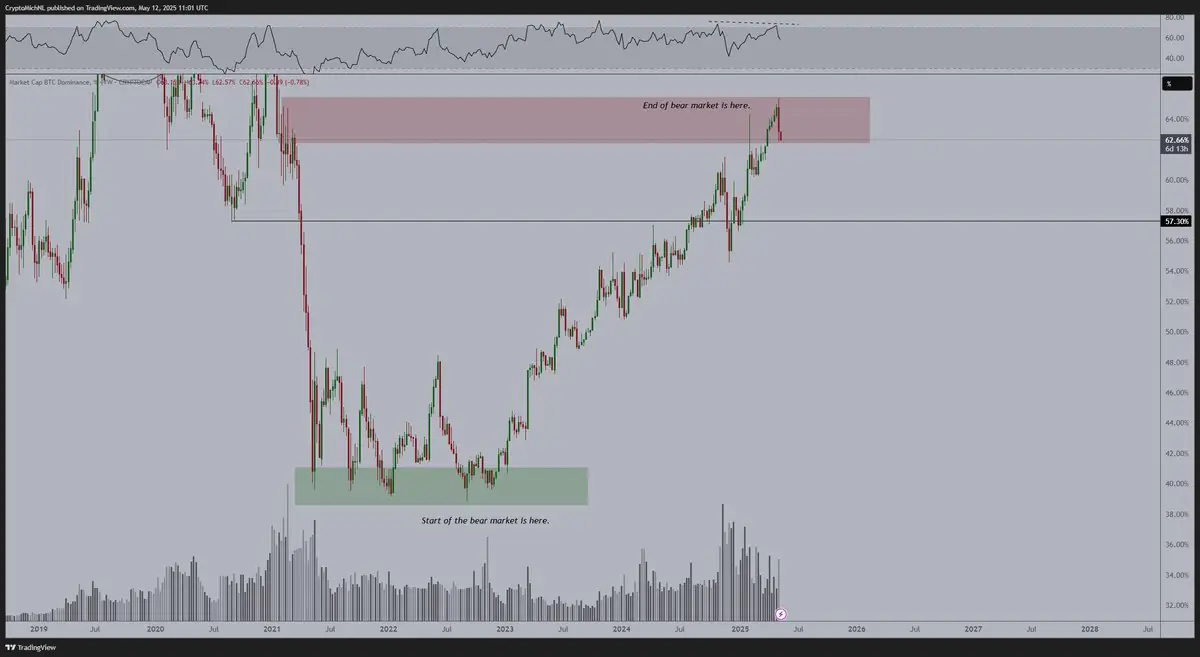

According to van de Poppe’s analysis, the Bitcoin Dominance Index (BTC.D) — which tracks Bitcoin’s share of the total crypto market cap — appears to have reached a local peak, historically indicating a capital rotation from Bitcoin into alternative cryptocurrencies.

Why This Matters

Bearish Divergence in Dominance

Bearish divergence occurs when the price (or in this case, dominance) moves higher while momentum indicators such as RSI trend lower. This typically suggests weakening strength and an impending reversal.

Cycle Rotation into Altcoins

Historically, peaks in BTC dominance precede altcoin rallies. As Bitcoin consolidates or slows its upward momentum, investors often seek higher returns in mid- and small-cap crypto assets.

End of Altcoin Bear Market

The chart shared by van de Poppe marks the current zone as the “end of bear market” region — where Bitcoin’s dominance previously topped out in past cycles, such as 2021 and 2017.

With this signal flashing, many traders and investors are now closely watching for renewed strength across altcoins, potentially signaling the start of a multi-week altcoin season.

The post Bitcoin Dominance Peaks: Altcoin Season Ahead? appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·