As BTC begins to rally after its most recent bear market, Peterson questions whether we’re witnessing a “Bitcoin Bull Trap.” This type of rally is not new — it has happened three times in the past, notably during the bear markets of 2018, 2022, and 2024.

A “bull trap” is a psychological occurrence where investors prematurely jump into the market on signs of recovery, often driven by the optimism sparked by positive news, even when the fundamentals of the market have not significantly changed.

The Pattern of Bull Traps

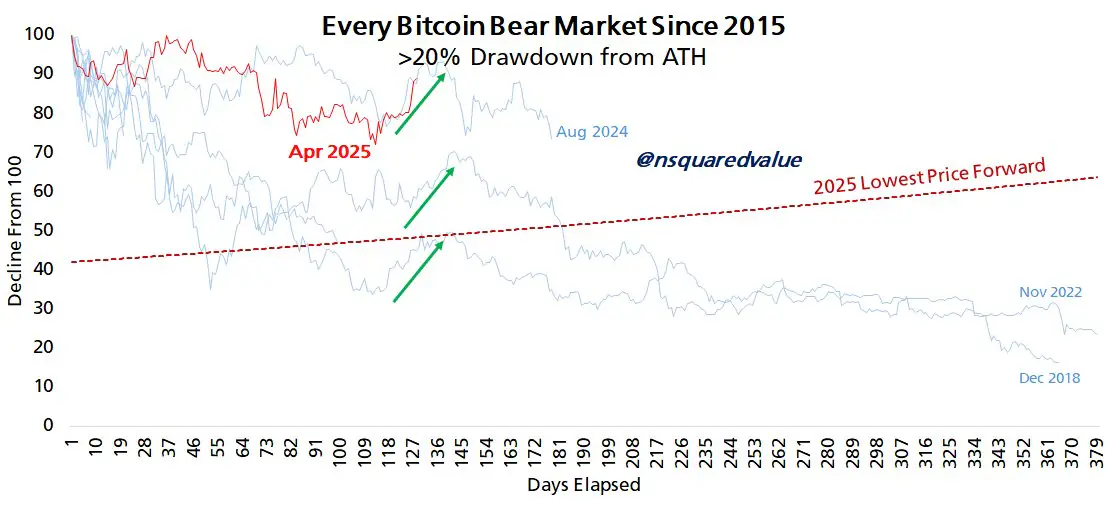

What makes this particular rally noteworthy is its timing. In each of the past bear markets, these rallies happened around the same point: day 120, roughly four months after the market starts its decline. This pattern seems to follow a psychological cycle where, at this point in the bear market, investors become exhausted by the prolonged downturn and start fearing further losses. They then latch onto any positive signal as a sign that the market may be turning a corner, which often turns out to be a false signal. The rally could very well be a temporary anomaly, masking the continuation of the broader market decline.

Peterson highlights that there are indeed compelling reasons to believe that the bear market might be over. For example, one potential signal of market recovery is the VIX, an index measuring market volatility. However, Peterson also cautions against prematurely jumping to conclusions. He notes that the world of investing is often rife with conflicting, incomplete, and sometimes incorrect information, making it difficult to discern genuine market signals from mere noise.

The Question at Hand

The critical question Peterson raises is: Which situation are we witnessing right now? Is this the beginning of a true recovery, or are we simply caught in a bull trap? The answer lies in understanding the psychological state of the market and the role of fear and greed in driving investor behavior. As the chart Peterson includes in his tweet illustrates, Bitcoin’s price history has shown a recurring pattern of decline followed by false rallies. The question remains whether the 2025 outlook will follow the same trajectory.

Looking Ahead

What is clear is that Bitcoin’s market dynamics continue to be complex. While there are signals indicating a potential end to the bear market, such as the decline in the VIX, it’s essential to be cautious. Investors should carefully assess market fundamentals and avoid being swayed by emotions and short-term news. Only time will tell whether this rally is the beginning of a new bull run or just another temporary relief before another drop.

The post Bitcoin Bull Trap? Analyzing the Psychology Behind Crypto’s Latest Rally appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·