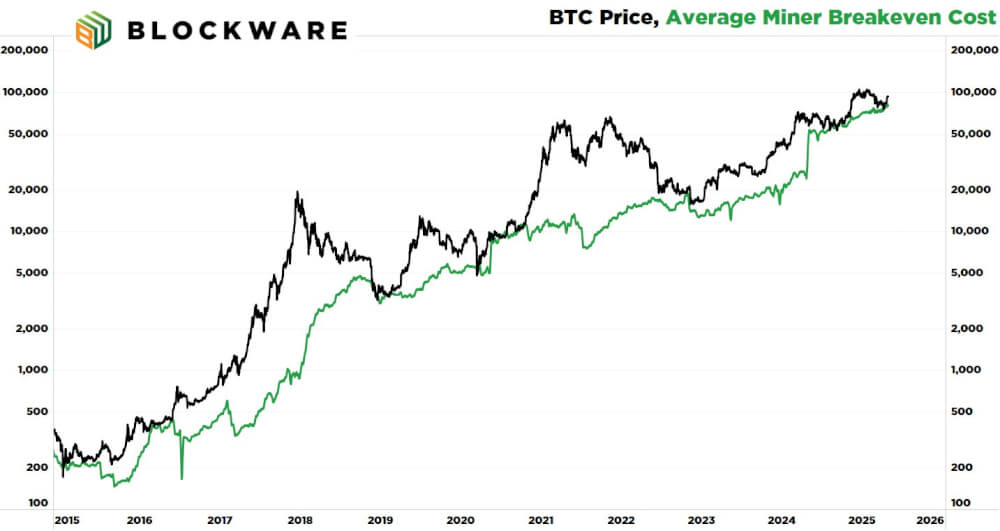

Drawing on data from industry analysts and historical trends, Breedlove highlighted a key metric known as the Average Miner Cost of Production, which has historically timed major Bitcoin reversals.

Breedlove emphasized that Bitcoin is up 25% since its April 9th low and noted that indicators such as the industry average cost to mine a Bitcoin point to a potential bullish reversal. According to data aggregated by the Blockware team, this metric has successfully signaled each of the last six Bitcoin bottoms: April 2016, December 2018, March 2020, September 2020, November 2022, and September 2024.

The rationale behind this indicator is rooted in the economics of mining. Assets typically do not trade below their cost of production in rational markets. For Bitcoin, this breakeven point varies based on machine efficiency, electricity costs, and operational uptime. Still, a reliable average can provide meaningful insight.

A chart shared by Blockware shows how the price of Bitcoin has historically followed the trajectory of the average miner breakeven cost. As current metrics again converge, Breedlove suggests that Bitcoin may be positioned for another significant rally.

While Breedlove rarely comments on short-term price action, the convergence of historical accuracy and current market behavior makes this signal hard to ignore. For those tracking market cycles, this may be a strong confirmation of a new upward phase for Bitcoin.

The post Bitcoin Bottom Signal Flashes Again as Mining Cost Metric Predicts Rally appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·