With the addition of Adorno—an expert in monetary plumbing—the report expands beyond price action into the systems that feed it: repo markets, regulation, and bond flows. This integrated view now links BTC’s on-chain signals with fiscal policy and monetary liquidity.

Policy Tilt: Trade Risks Fade, Stimulus Builds

The Trump administration’s dual-tone approach—veering between protectionism and pro-growth posturing—continues to drive uncertainty. Markets initially reacted to a proposed 50% EU tariff, only for Trump to delay the move, reinforcing the expectation of eventual deal-making.

Meanwhile, trade negotiations with China remain tense but show signs of easing. Investors are betting on a familiar pattern: tough talk followed by compromise, dubbed the “TACO trade”—Trump Always Chinese Out.

Despite legal challenges, courts reaffirmed Trump’s authority to enforce tariffs, cementing his leverage. However, recent policy moves signal a pivot toward stimulus. The Department of Government Efficiency (DOGE) proposed $9.4B in cuts—far below expectations—while a record spending bill advanced in parallel. The feared austerity cliff never arrived.

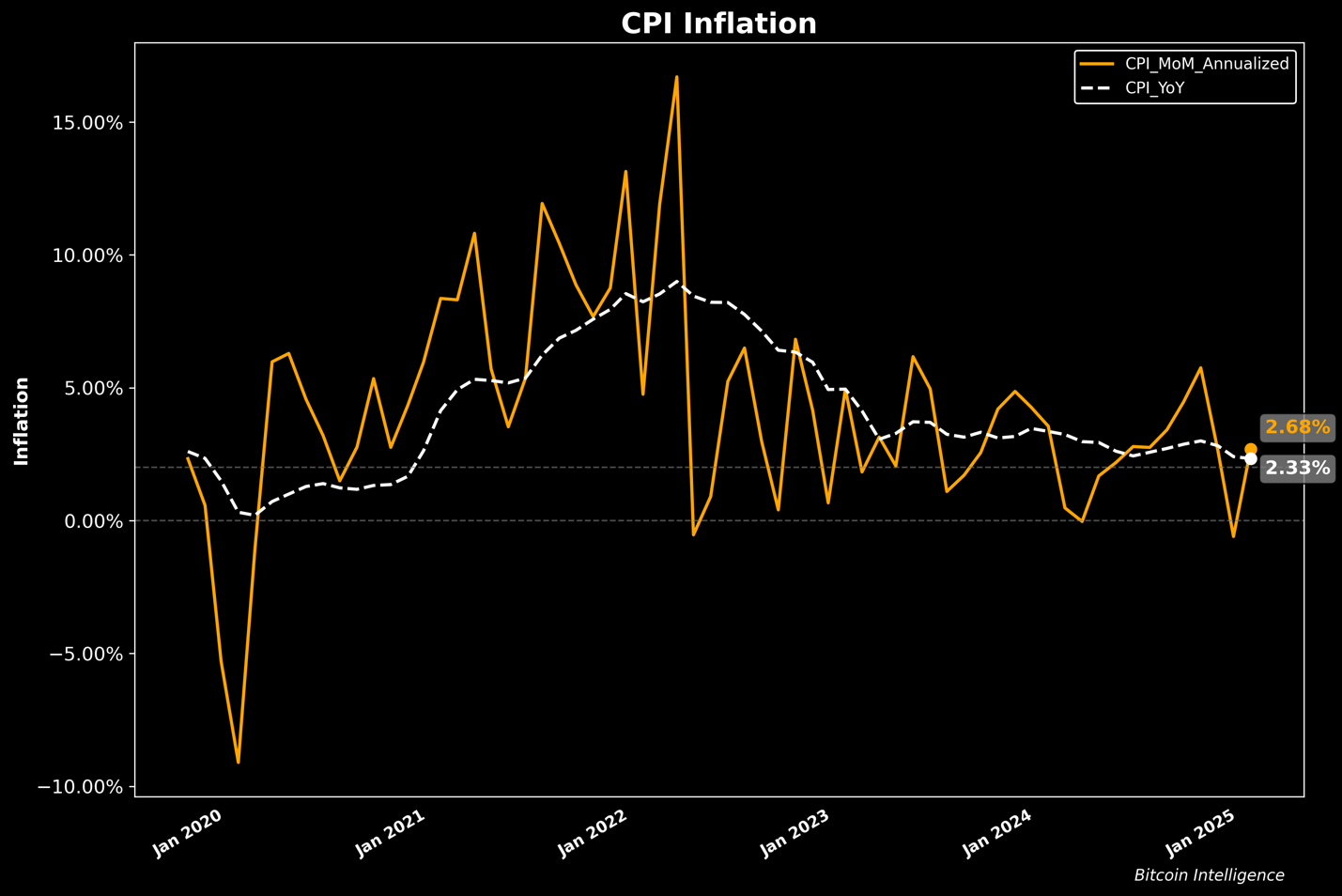

Disinflation Accelerates as Fed Gets Breathing Room

According to the report inflation data continues to undercut hawkish narratives. April’s CPI slowed to 2.33% YoY and 2.68% MoM annualized. PCE, the Fed’s preferred metric, came in at 2.15% YoY, with monthly prints well below target.

Core PCE hit its lowest level since 2021, giving the Fed space to reconsider its restrictive stance. With inflation softening and economic activity slowing globally, the report forecasts resumed rate cuts in the second half of 2025.

Bond yields are reflecting the trend. German 10-years fell to 2.519%, and UK gilts dropped to 4.6%, signaling waning growth expectations. China’s slowdown and IMF’s 4.0% growth forecast further bolster the case for global easing.

On-Chain Signals: Sellers Dominate Across All Cohorts

Bitcoin’s network activity points to widespread profit-taking. Data from the URPD metric reveals that 40% of recent selling came from December 2024 buyers in the $94K–$100K range. These investors, likely fatigued, are exiting after a prolonged drawdown.

Another 30% of selling came from the $75K–$90K range—those who bought into early 2025 dips but are now scaling back. Notably, even long-term holders with sub-$70K cost bases contributed to sell pressure, realizing profits amid stalling price action.

This multi-cohort exit wave has driven Bitcoin back toward the $104K mark. The report views this as a typical “multi-cycle unwind,” where sentiment, liquidity friction, and fading momentum converge to stall upside.

Conclusion: Fundamentals Still Supportive, But Caution Warranted

Despite short-term stressors, the liquidity backdrop remains constructive. The analysts expect policy to stay pro-market, with inflation easing and fiscal support growing.

Still, Bitcoin finds itself in transition. A broad wave of distribution and macro caution is capping upside for now. Yet as monetary policy pivots back to easing, Bitcoin remains poised to benefit more than any other asset—once conviction returns.

The post Bitcoin at a Turning Point: Liquidity, Policy, and Sell-Side Pressure Collide appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·