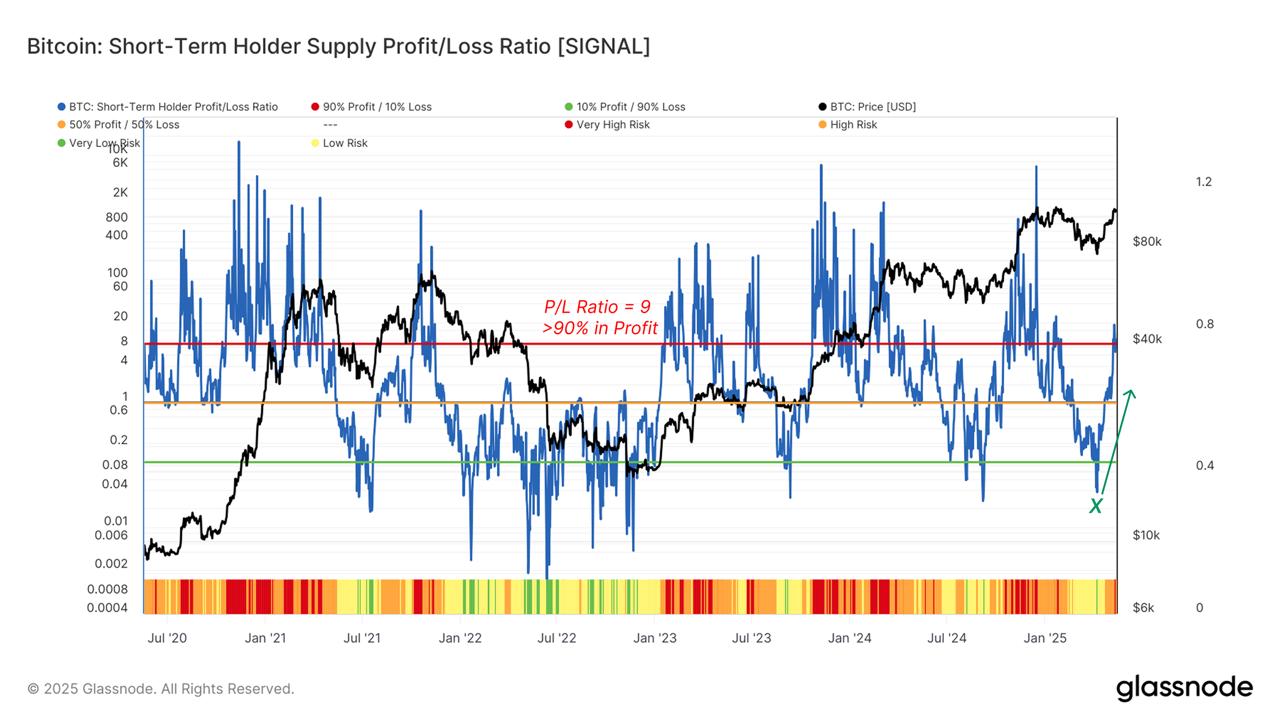

This metric proved especially insightful during the correction on April 7, when it dropped to 0.03, signaling that nearly all STH-held supply was underwater. This low was recorded as BTC hit its $76k price floor. Since then, the ratio has surged above 9.0, meaning more than 90% of STH supply is now back in profit.

High Sentiment Could Signal Market Risk

While a ratio above 9.0 indicates strong profit for short-term holders, it can also signal heightened market risk. As more investors find themselves in profit, there is an increased chance of profit-taking, which could lead to a local top if new demand slows down.

As long as the STH Supply in Profit/Loss Ratio remains well above the equilibrium level of 1.0, the bullish momentum is likely to persist. However, any prolonged drop below this threshold could indicate a shift in market strength and suggest the potential for trend exhaustion.

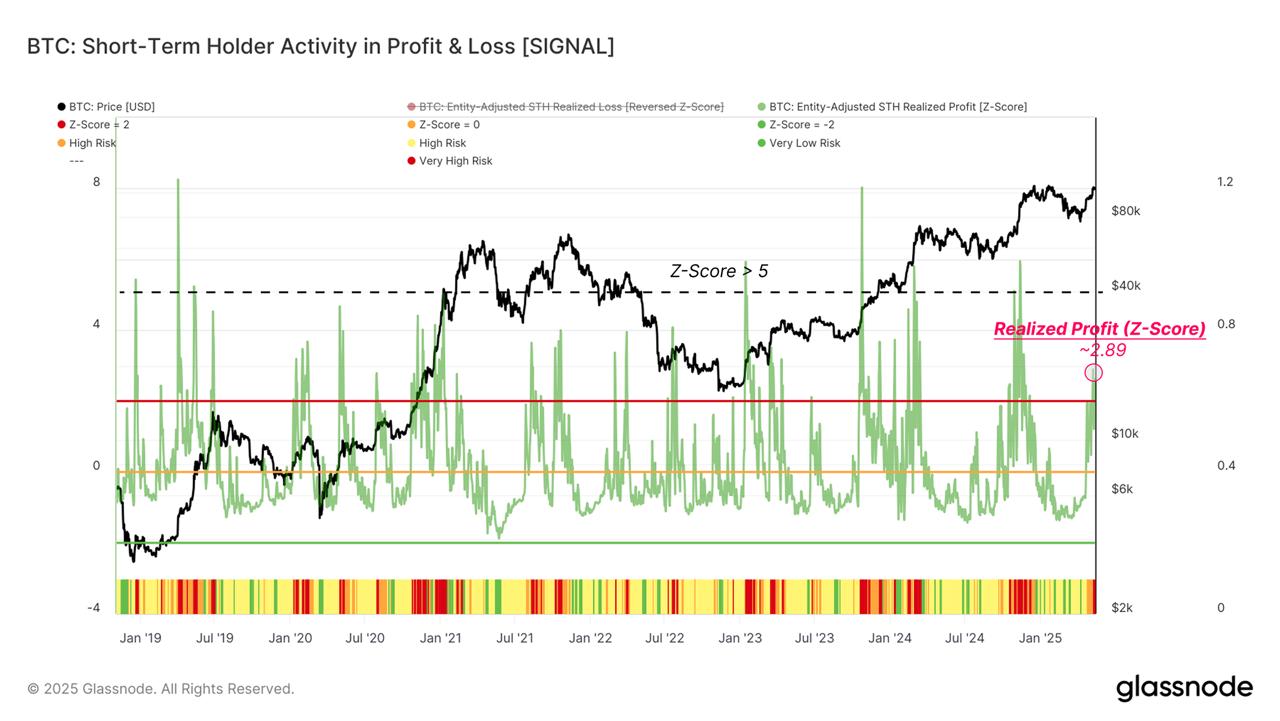

Profit-Taking Surge, But Room for More

With short-term holders sitting on significant unrealized gains, the market may see increased profit-taking. Monitoring the behavior of this group is essential to identifying when demand exhaustion might approach, especially near a potential local top.

The recent surge in STH Realized Profit, now almost +3 standard deviations above its 90-day average, reflects a notable increase in profit realization. Historically, during previous rallies towards Bitcoin’s all-time high, this metric has reached over +5 standard deviations, signaling that much stronger profit-taking pressure is often necessary to counteract the inflow of fresh demand.

The post Bitcoin Approaches $109k: Short-Term Holder Sentiment Shifts appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·