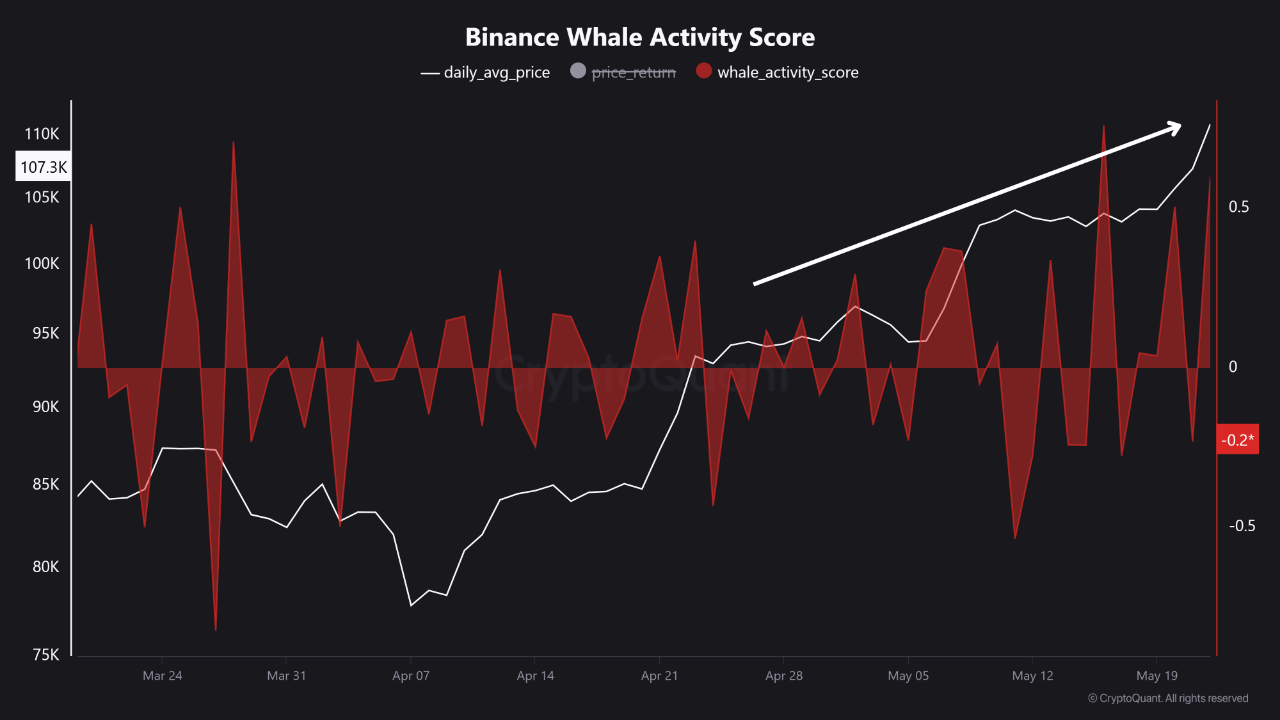

The Binance Whale Activity Score, which tracks high-volume inflows and outflows from the exchange’s top 10 whale wallets, has surged in recent days.

According to data, shared by CryptoQuant, such behavior often precedes major price movements.

“Whale inflows suggest distribution or positioning for large moves, while outflows indicate accumulation or capital redeployment,” the analyst noted.

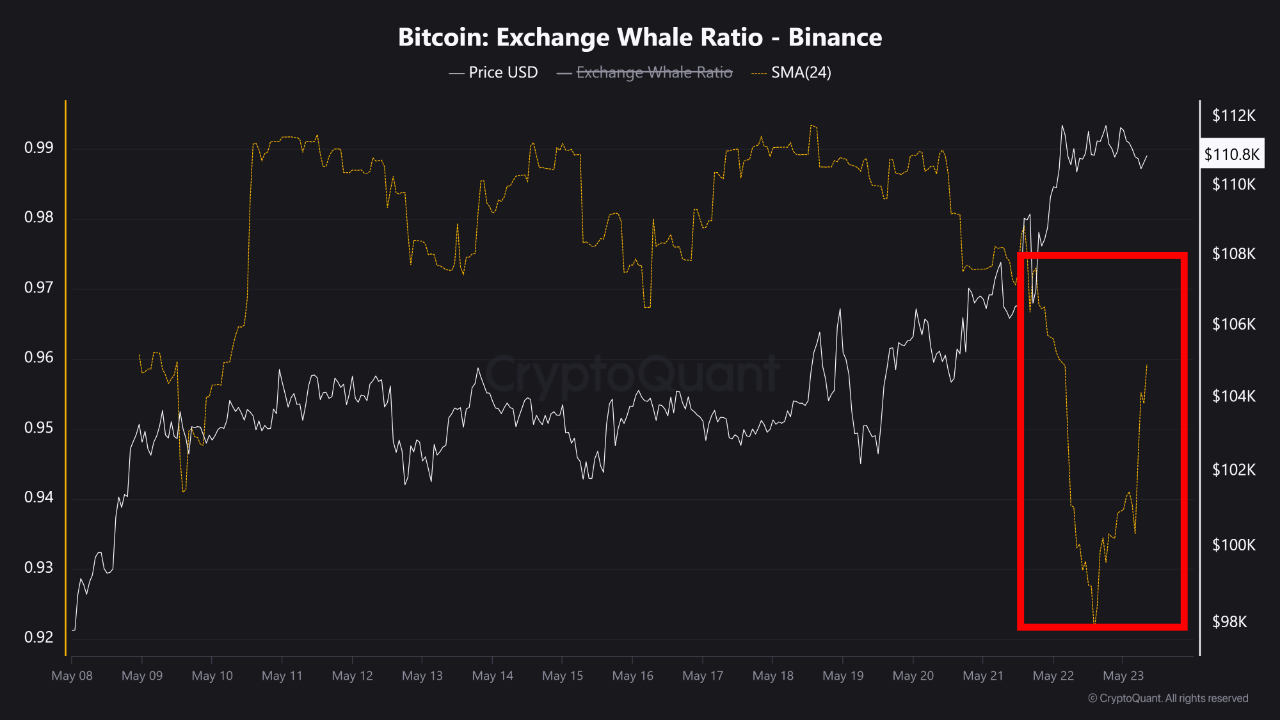

This spike in whale activity coincides with a visible drop in the Exchange Whale Ratio on Binance — a metric that fell sharply during Bitcoin’s pullback to below $100,000, before recovering along with price. The drop suggests that whale deposits were diluted by rising inflows from smaller traders, a potential sign of broader retail participation.

The BTC price, now trading under $110,000, appears to be responding to this shifting on-chain dynamic. Historically, whale movement on Binance has proven to be a leading indicator for market momentum due to the platform’s dominant role in crypto price discovery.

“Ignoring Binance whale flows is ignoring the heartbeat of crypto’s price action,” analysts warned.

What to Watch

Whale inflow spikes: Could signal distribution or hedging ahead of volatility Outflow surges: Often indicate whale accumulation or off-exchange deployment Sustained high scores: Suggest upcoming trend shifts or liquidity wavesAs whales re-enter the scene, traders and analysts are closely monitoring Binance flows for clues on Bitcoin’s next major move.

The post Binance Whale Activity Surges, Signaling Possible Bitcoin Volatility Ahead appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·