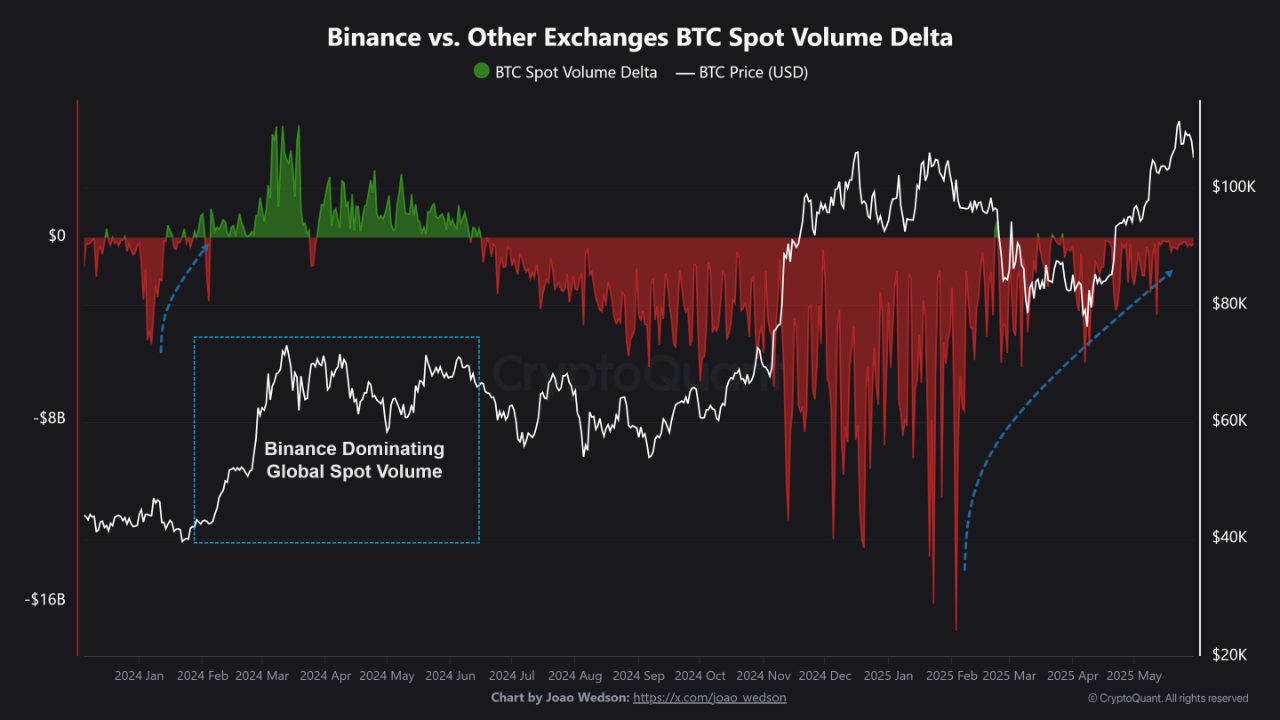

This rare scenario last occurred during the post-Bitcoin ETF launch phase, which marked a wave of institutional entry into crypto markets. Back then, this dominance fueled a strong bullish push for BTC, and Wedson hints the same could happen again.

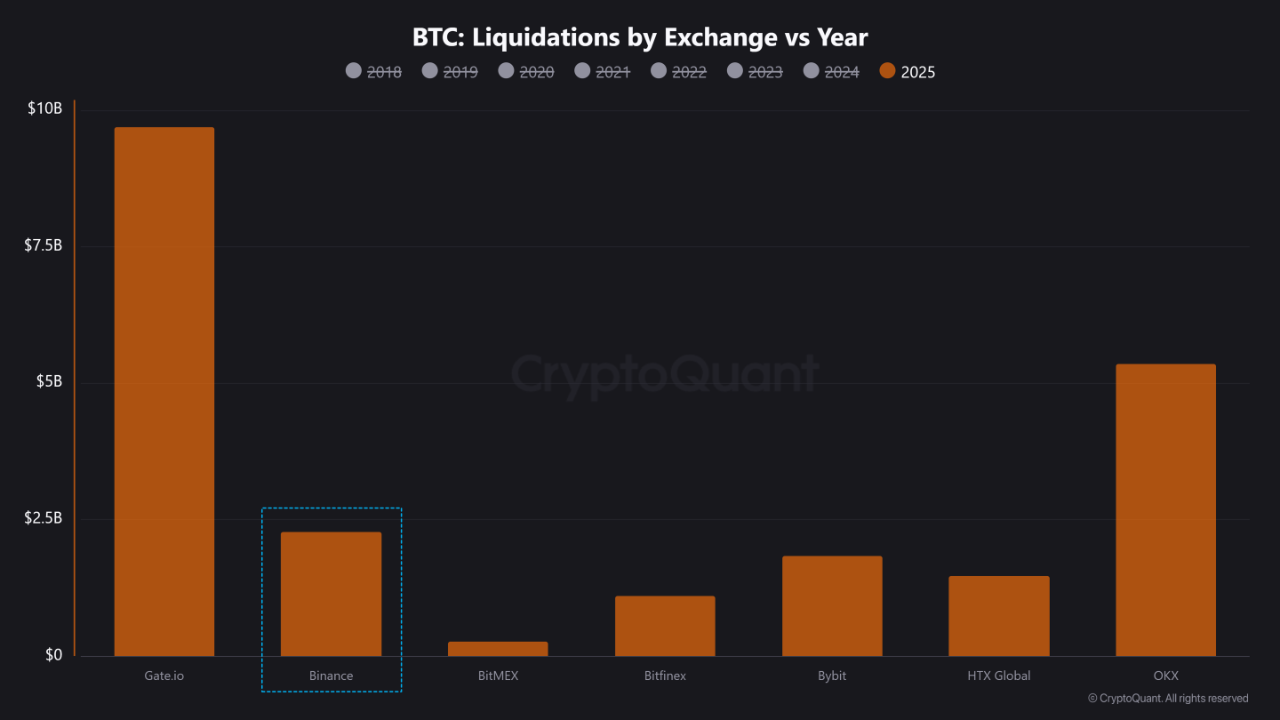

Despite Volume Lead, Binance Trails in Liquidations

While Binance remains the top player in both spot and derivatives volume, it’s surprisingly not the exchange with the most liquidations in 2025. Data shows OKX and at least one other exchange surpass Binance in total liquidations this year.

This highlights a key dynamic: volume dominance doesn’t always mean high liquidation activity. Binance’s liquidity depth may be absorbing volatility more efficiently, or its traders could be managing risk better.

Liquidity Drives Market Behavior

Wedson’s key message is simple: liquidity matters. Exchanges with deeper liquidity tend to show more stable price behavior and lower liquidation volatility. For traders, choosing platforms wisely based on market structure—not just volume—can be crucial.

As the charts show, Binance continues to dominate global spot volume, but liquidation hotspots have shifted, revealing new trading dynamics that may influence future price movements.

The post Binance Spot Volume Nearly Surpasses All Other Exchanges Combined appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·