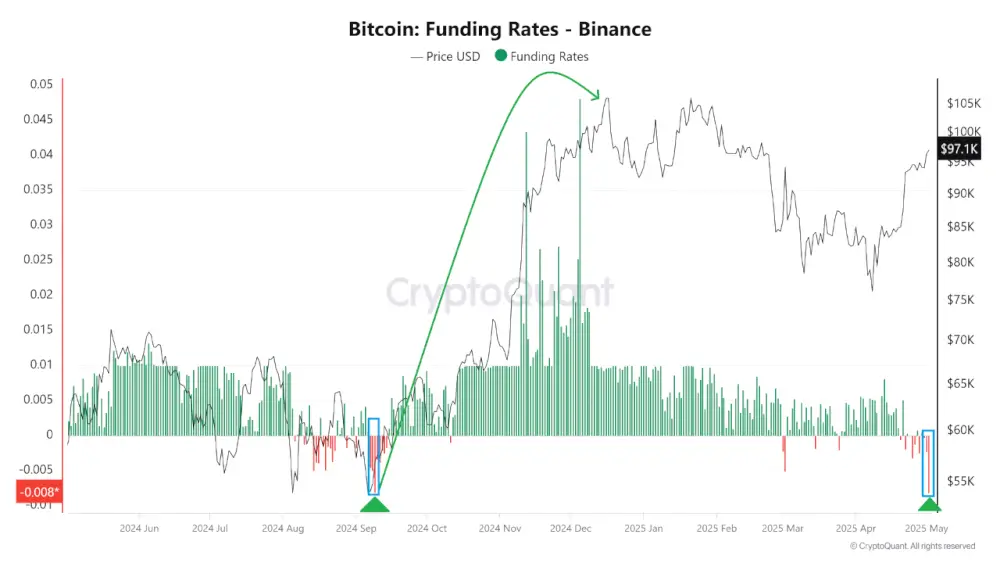

The data was shared by leading on-chain analytics platform CryptoQuant, highlighting this rare event as traders reassess market positioning.

What Are Funding Rates, and Why Do They Matter?

Funding rates are recurring payments between traders in perpetual futures markets. A positive rate suggests that long traders (those betting on rising prices) are dominant and are paying shorts to maintain their positions. A negative funding rate, on the other hand, means shorts are in control and are paying longs — a sign that sentiment has turned sharply bearish.

CryptoQuant’s latest metrics show that this drop into negative territory reflects an increase in aggressive shorting by retail traders, rather than underlying weakness in Bitcoin’s fundamentals.

What Could This Signal?

1. Short Squeeze Setup

Extreme negative funding rates like -0.008% can create fertile ground for a short squeeze. If Bitcoin rebounds even slightly, it could force heavily shorted traders to cover their positions, causing prices to surge rapidly.

2. Potential Market Bottom

As noted by CryptoQuant, similar setups in the past — including in September 2024 — marked local bottoms. When pessimism reaches such extremes, it often precedes trend reversals, especially when paired with on-chain evidence of institutional buying.

Whales Tell a Different Story

Adding weight to the reversal narrative, CryptoQuant’s Whale Screener showed that over $300 million worth of BTC was withdrawn from exchanges on May 1 and May 2. These large outflows suggest accumulation by whales, in stark contrast to the retail-driven panic in derivatives markets.

The divergence between retail shorting and whale accumulation paints a complex picture — but if history is any guide, current conditions may be setting up for another bullish move.

The post Binance Bitcoin Funding Turns Deeply Negative for First Time Since Sep 2024 appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·