TLDR

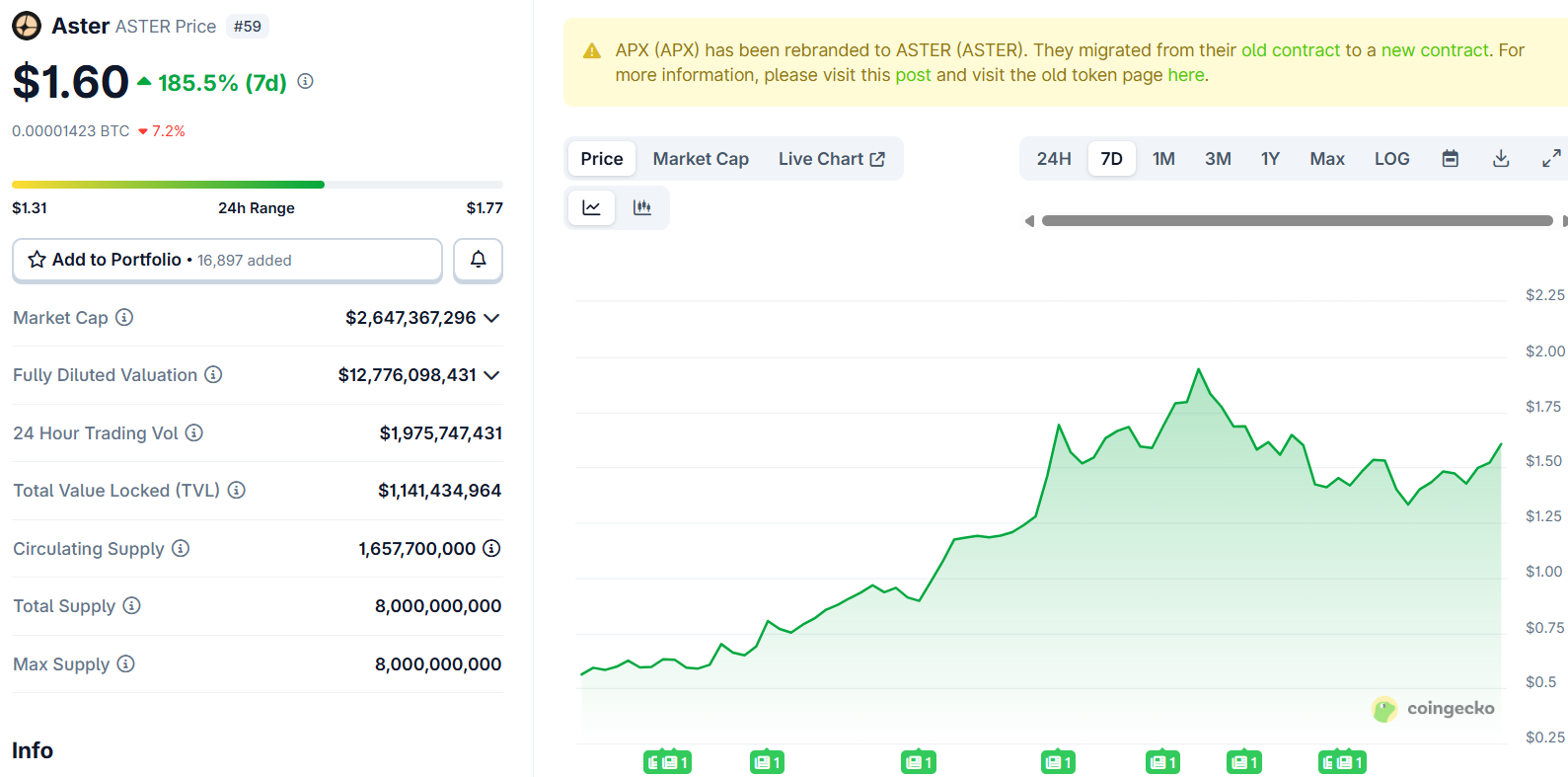

ASTER token rocketed 7,000% from $0.02 to $2 since September 17 launch Six wallets reportedly control over 96% of token supply, sparking manipulation claims Binance founder CZ endorsed the project, leading to exchange listings on Bitget and Bybit Aster DEX overtook Hyperliquid with $793 million daily trading volume Token has pulled back to $1.60 but market cap remains around $2.64 billionThe Aster token launched on September 17 at $0.02 per token. Within just four days, the price exploded by more than 7,000% to reach $2 on September 21.

ASTER Price

ASTER Price

This dramatic surge pushed ASTER’s market capitalization to $3.3 billion at its peak. The token has since retreated to $1.60, bringing the market cap down to approximately $2.64 billion.

Binance founder Changpeng Zhao posted about Aster on social media shortly after the token’s launch. His endorsement highlighted the platform’s multi-chain support and hidden order features.

Following CZ’s post, multiple exchanges moved quickly to list ASTER. Bitget and Bybit added the token as a new spot trading pair. The token is also available on decentralized exchanges across BNB Chain, Ethereum, Solana, and Arbitrum networks.

Supply Concentration Raises Questions

Market participants have raised concerns about ASTER’s token distribution. Reports suggest that just six wallets hold or control more than 96% of the token’s total supply.

Some critics claim that Binance holds 95% of the 1.65 billion ASTER tokens currently in circulation. This concentrated ownership structure has led to allegations of potential market manipulation.

Crypto trader Cyclop noted that the project lacks a working product to justify its valuation. He pointed out that investors cannot short the token, which helps maintain upward price pressure.

The trader argued that controlled supply can be bullish when managed by trusted parties. He stated that this approach allows project backers to influence price direction through supply management.

Trading Volume Surge

Aster’s decentralized exchange has experienced massive trading volume growth. Data from DefiLlama shows the platform processed $793 million in transactions over 24 hours on September 21.

Source; DefiLlama

Source; DefiLlama

This volume surge allowed Aster to overtake Hyperliquid, which recorded $462 million in daily volume. Aster moved into the top six decentralized exchanges by daily volume.

Over the past seven days, Aster cleared approximately $1.79 billion in trades. This figure remains below Hyperliquid’s weekly volume of $5.78 billion.

The DEX platform offers hidden orders that allow users to place trades without exposing their positions. This feature helps reduce front-running and limits price manipulation opportunities.

CZ specifically mentioned this “shadow zone” functionality in his social media post. He noted that Aster supports multiple blockchain networks natively, unlike other perpetual DEX designs.

Large Investor Activity

The token’s price rally has attracted whale investors looking to capitalize on the momentum. Blockchain analytics firm Lookonchain tracked several large bets on ASTER.

An influencer known as CookerFlips withdrew 5.57 million ASTER tokens after depositing $1.24 million. This position generated approximately $5 million in profit within three days.

ogle(@cryptogle), advisor of @worldlibertyfi, reopened a 3x leveraged long on $ASTER and is now sitting on an unrealized profit of $357K.

He previously realized a profit of $986K on two $ASTER long trades.https://t.co/Wx96LcRS25 pic.twitter.com/AE746WgTtP

— Lookonchain (@lookonchain) September 21, 2025

World Liberty Financial advisor Ogle opened a 3x leveraged long position on ASTER. He currently holds $357,000 in unrealized gains after taking nearly $1 million in realized profits from earlier trades.

Some social media users speculated about ASTER’s listing strategy on perpetual futures markets before spot markets. They suggested this approach was designed to encourage short positions that could later be liquidated.

The token briefly dipped to $1 before recovering to approach the $2 level. Market participants expect continued volatility as trading activity remains elevated across multiple exchanges and blockchain networks.

The post Aster Price: Token Gains 7,000% After Exchange Listings and CZ’s Endorsement appeared first on CoinCentral.

1 month ago

33

1 month ago

33

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·