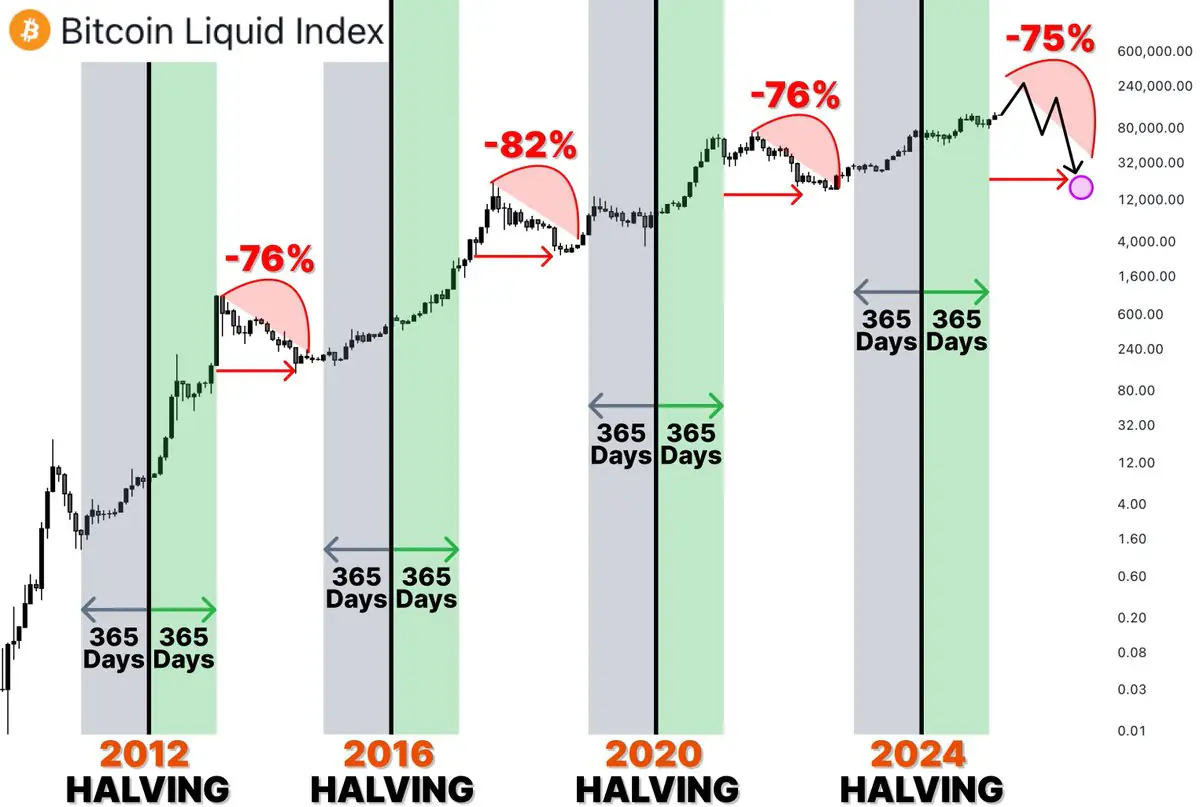

A chart shared by the analyst underscores a recurring pattern of post-halving growth that has played out consistently across the last three cycles.

Historical Halving Blueprint

The chart tracks Bitcoin’s performance around each of its four halving events—in 2012, 2016, 2020, and 2024. In every cycle, BTC experienced significant drawdowns of 75% to 82% from its peak, followed by a year-long accumulation period and a subsequent explosive rally.

2012 Halving: Preceded a multi-hundred percent rally before a 76% correction. 2016 Halving: Price surged, only to see an 82% drop afterward. 2020 Halving: Led to another 76% correction, before climbing to new all-time highs. 2024 Halving: Currently in progress, with historical data pointing to the possibility of a major upward move within 365 days of the halving.

2025 Outlook: $180,000 Target in Sight?

If the pattern continues, Bitcoin could be on track for another exponential leg up. Klarch suggests that the halving event in April 2024 has already laid the groundwork for the next bull phase, and that 2025 could mirror previous post-halving years.

According to the chart, shared by the analyst The current structure aligns with previous cycle behavior—365 days of accumulation and consolidation following a halving, leading into a full-blown price breakout. With this historical trend, Klarch sees a compelling case for Bitcoin reaching $180,000 by late 2025.

Conclusion

Bitcoin’s past performance doesn’t guarantee future results, but Klarch’s data-backed projection offers a compelling narrative for bullish investors. As halving cycles continue to shape the asset’s long-term trajectory, traders and institutions alike are watching for signs that history may once again rhyme.

The post Analyst Predicts $180K Bitcoin Rally in 2025, Cites Halving Cycle as Key Catalyst appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·