You can't fault AMD for its honesty. Not when it is unambiguously, almost proudly, admitting that it charges more for its CPUs than Intel.

At the Communicopia+ Technology Conference held recently by the high-status bean counters at Goldman Sachs, AMD's Executive VP & GM of Data Center Solutions Business Unit, Forrest Norrod, was remarkably frank about AMD's CPU pricing. "We charge more for our CPUs than our competitor does," Norrod says, "and the reason is because we're giving superior value."

Norrod doesn't call out Intel by name. But it's clear enough who that "competitor" is. "We're giving performance, we're giving reliability," Norrod goes on, "we're giving things that allow us to charge for that technology and for the customers to feel good about the price that they're paying."

Norrod was speaking primarily about AMD's server CPUs, which he pointed out have been a massive success story for the company. "According to [market research outfit] Mercury, we're at 41% share on server CPUs, up from essentially zero when we started this journey about seven years ago. And our share continues to grow there very rapidly on the CPU side. We picked up about eight points of share in the last 12 months. And if anything it's picking up speed."

Back on ye olde desktop, AMD doesn't seem to quite carry the same bravado. Right now on Newegg, the Intel Core Ultra 9 285K and AMD Ryzen 9 9950X are priced within a single dollar of each other, at $539.99 and $538.99 respectively.

That implies AMD doesn't think the 9950X is superior to Intel's 285K. Then again, the going rate for the AMD Ryzen 9 9950X3D is currently $699 on Newegg. Draw your own conclusions, as they say, although you could argue the X3D chips with their added V-cache currently operate in a segment of their own. But isn't that the point Norrod was making? That AMD will charge more when it offers more?

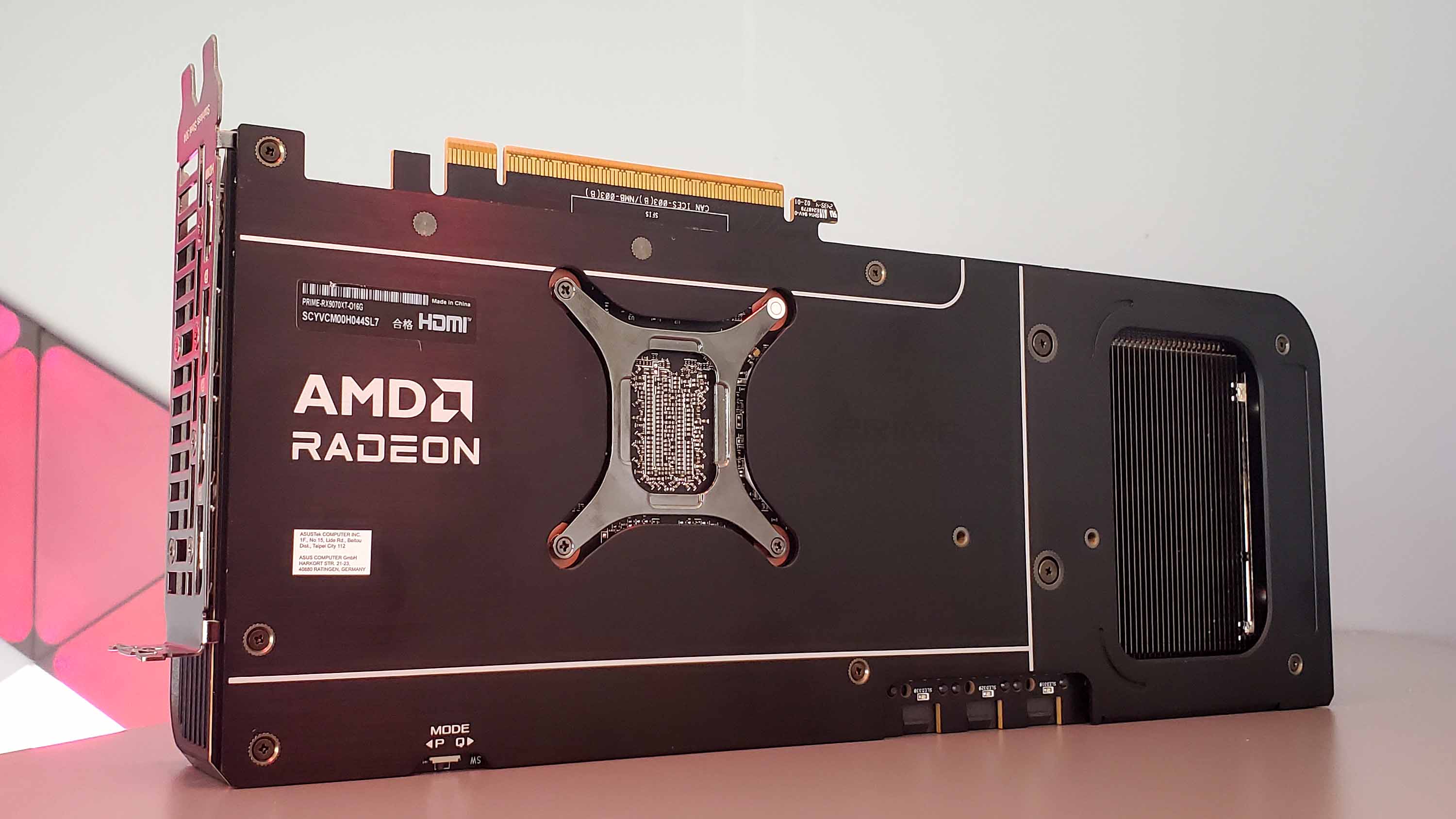

Anywho, one corollary where all this could be a bit concerning is graphics. Even as things stand right now, it's hard to argue that AMD is offering a clearly superior value proposition with its RDNA 4 GPUs, such as the Radeon RX 9070 XT. You're looking at $700 for one of those.

That's a graphics card that falls in between the RTX 5070, which can be had for $550, and the RTX 5070 Ti, which is available for around $750, for pure raster rendering performance, but which most gamers would agree doesn't match the Nvidia options for features like upscaling and ray-tracing support.

In other words, AMD doesn't have clearly the best GPU tech right now, but it's still pricing its graphics cards pretty high. If you then consider Norrod's comments above about server CPU pricing and the way AMD positions the X3D gaming CPUs, well, you have to wonder whether AMD bringing out a new generation of GPUs that match or even beat Nvidia across the board would do much if anything to help bring prices down.

That probably reflects the fact that a mere duopoly of companies supplying the market with gaming GPUs is never going to create the same dynamic of competition as four or five companies going after gamers. Heck, even three with the addition of Intel would be really welcome.

Moreover, the problem with AMD when it comes to gaming GPUs of late, is that all the evidence points to the company choosing not to produce graphics cards in really big numbers.

As we reported, the latest data from JPR shows AMD's PC graphics card market share actually falling, despite the latest full quarter of sales figures coming after the release of RDNA 4 graphics cards. Admittedly, we haven't quite got a full picture of how RDNA 4 and particularly the newer and presumably higher-volume Radeon RX 9060 XT cards are performing. But it certainly doesn't look like AMD has flooded the market.

Instead, it seems more like AMD is taking a low-risk approach. If it makes cards in relatively low volumes, they're pretty much guaranteed to sell out even when priced up near the Nvidia competition. And that probably means fat profit margins without the need to book a larger and more risky and expensive production allocation at Taiwanese chip maker TSMC, where all AMD GPUs are currently made.

If all that is roughly the case, you can understand why AMD does it. But it's not much help for gamers who remember the days not so long ago at all that $500 was a pretty hefty chunk of change for a GPU. Now it barely gets you on the bottom rung of the mid-range. Ouch.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·