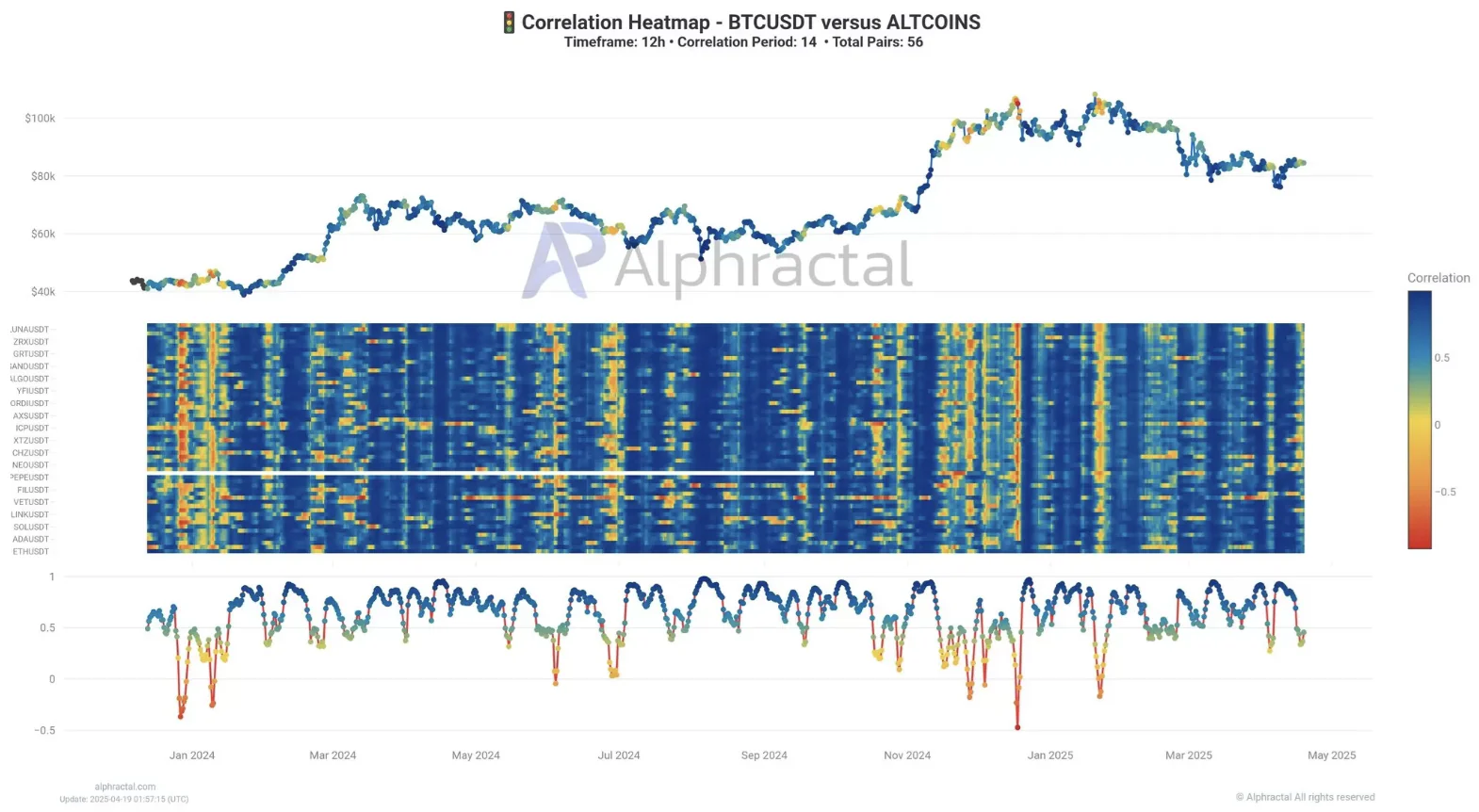

According to Alphractal, these correlation declines, especially on short-term charts like daily or hourly, may serve as early signals for potential market shifts.

Key Insights from Alphractal’s Analysis

Sideways Movement of Bitcoin after Bullish Trends: Alphractal noted that when Bitcoin experiences sideways movement after a bullish run and altcoin correlation begins to drop, this typically indicates a broader market decline. The sudden disconnection between Bitcoin and altcoins can act as a warning that the positive momentum is fading, with a possible price decline across the market.

Recovery Signs Followed by Correlation Decline: Another pattern identified is when Bitcoin shows signs of recovery after a few days of downtrend, but the correlation between it and altcoins starts to fall again. This, according to Alphractal, suggests that the bearish trend may not have fully ended yet, signaling potential further downward pressure on prices.

High Correlation During Market Trends: A high altcoin correlation with Bitcoin, especially when it hovers around a value of 1, typically points to a consolidation phase or a clear market trend. Alphractal observed that this alignment indicates the market is following a consistent direction, whether bullish or bearish, without much deviation.

Market Impact and Investor Reactions

The platform emphasized that these correlation drops are often short-lived and can leave many investors perplexed. This confusion, coupled with the lack of clear direction, may lead to increased volatility and heavy liquidations, potentially marking altcoin tops or bottoms. Alphractal pointed out that while these moments may seem chaotic, they are common occurrences in volatile markets and can offer both risks and opportunities for experienced traders.

READ MORE:

Bitcoin Price Prediction From 21Shares

Broader Context: Switzerland’s Bitcoin Adoption Movement

In related news, Switzerland is taking steps toward greater Bitcoin adoption, signaling a shift in global crypto trends. As the country embraces Bitcoin more fully, it further highlights the increasing intersection of digital assets with traditional financial systems.

Conclusion

Alphractal’s insights into Bitcoin and altcoin correlation offer critical insights for investors looking to navigate volatile markets. By keeping an eye on sudden changes in correlation, especially during periods of sideways movement or market consolidation, traders can better anticipate potential shifts and adjust their strategies accordingly.

The post Alphractal Highlights Bitcoin and Altcoin Correlation Insights appeared first on Coindoo.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·