TLDRs;

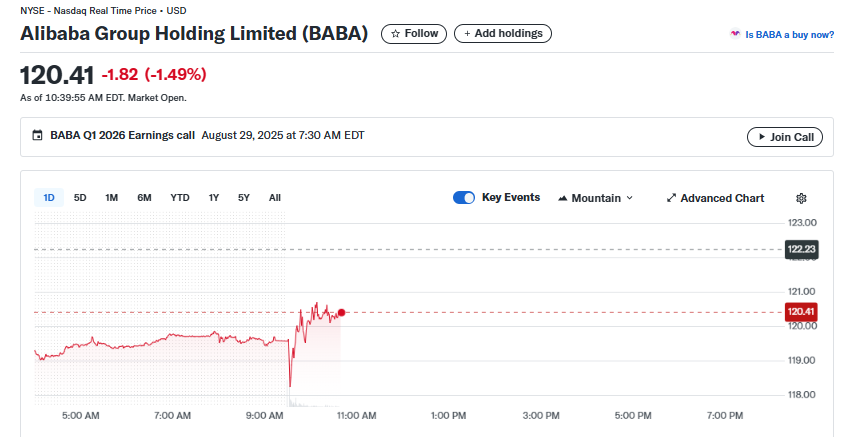

Alibaba stock dipped 1.49% Wednesday as the company pursued refinancing talks for a $6.5B loan due in 2026. The company is preserving liquidity for a $53B AI and cloud expansion while offering favorable refinancing terms below 80bps over SOFR. Alibaba returned $16.5B to investors in fiscal 2025 through $11.9B buybacks and $4.6B dividends, cutting shares by 5.1%. Cloud revenue rose 18% to $4.15B, with AI products achieving triple-digit growth for the seventh straight quarter.Alibaba Group Holding Ltd. (NYSE: BABA) shares slipped 1.49% on Wednesday, even as the company unveiled a dual strategy of rewarding shareholders with $16.5 billion in returns while pursuing talks to refinance a $6.5 billion loan due in 2026.

The modest stock decline underscores investor caution, as Alibaba seeks to balance near-term capital distributions with long-term investments in artificial intelligence (AI) and cloud computing, sectors the company sees as critical to its future growth.

Alibaba Group Holding Limited (BABA)

Alibaba Group Holding Limited (BABA)

Refinancing a $6.5B Loan

According to sources cited by Bloomberg, Alibaba is negotiating with banks to refinance a $6.5 billion loan that matures in 2026. The company has proposed a five-year revolving credit facility, offering lenders a rate of less than 80 basis points above the Secured Overnight Financing Rate (SOFR).

Despite sitting on $50.2 billion in net cash, Alibaba’s decision to refinance rather than repay the debt outright reflects its strategy to preserve liquidity while securing low-cost funding. Much of this capital will be funneled into a $53 billion infrastructure plan designed to bolster the company’s cloud and AI businesses.

This approach is seen as strategic, given that large-scale AI and cloud projects typically take years to generate meaningful returns. The timing of the new five-year loan lines up neatly with Alibaba’s investment horizon.

Cloud and AI: Growth at Full Speed

Alibaba’s Cloud Intelligence Group has become the centerpiece of its transformation from an e-commerce giant into a broader technology powerhouse. The division reported 18% revenue growth last quarter, reaching $4.15 billion in sales, while AI-related products have now posted seven consecutive quarters of triple-digit growth.

Recent product launches have reinforced this momentum. The Qwen3 AI model family has surpassed 300 million downloads globally, while the AI coding assistant Lingma continues to gain adoption among enterprise developers.

Alibaba sees AI and cloud computing as capital-intensive but high-margin opportunities, where upfront infrastructure spending is necessary to maintain competitiveness against global peers such as Amazon Web Services and Tencent Cloud.

$16.5B Returned to Shareholders

Even as it ramps up long-term investments, Alibaba has been generous with shareholder rewards. In fiscal 2025, the company returned $16.5 billion to investors, comprised of $11.9 billion in share repurchases and $4.6 billion in dividends.

These moves amounted to a 5.1% reduction in outstanding shares, signaling management’s confidence in Alibaba’s long-term value creation.

CEO Eddie Wu emphasized that the company remains committed to a “user-first, AI-driven” strategy, while also ensuring shareholders see tangible benefits from its strong cash flows.

Beyond E-Commerce

While Alibaba’s e-commerce platforms, led by Taobao and Tmall, posted modest 7% year-over-year growth, its international commerce unit surged 22%, reflecting rising global traction.

By combining loan refinancing with robust shareholder payouts, Alibaba is positioning itself to finance AI-driven innovation while maintaining liquidity and investor trust. The balancing act reflects the company’s evolution from a consumer marketplace into a diversified technology ecosystem spanning commerce, logistics, fintech, and cloud services.

The post Alibaba (BABA) Stock; Dips as Company Mulls Shareholder Payouts With $6.5B Loan Refinancing appeared first on CoinCentral.

3 weeks ago

12

3 weeks ago

12

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·