Money is the greatest teaching tool of all time. And when you throw kids and parents into the mix, it has the power to change lives. Years back, I watched as my own preschool-aged children, Luca and Laura, figured out that if you’ve got cash, you can get stuff. The summery jingle of the ice-cream truck was enough for them to drop any toy they had in the sandbox and bolt into the house demanding a couple of loonies for ice-cream—QUICK!—before the truck left. As my pockets were picked dry daily, I realized it was time to start teaching them the value of money.

Money experts will tell you I probably started too late. “Kids should be given a bit of spending money as soon as they are old enough not to eat it,” says Certified Financial Planner Trevor Van Nest. “Learning about money will be a lifelong process for them.” In fact, Van Nest and other financial experts generally agree that kids as young as two often understand more about money than parents give them credit for. “Just by watching you buy things at the store, they quickly figure out who has the power,” says Minnesota-based financial educator Ruth Hayden. “Your role is to help them understand that money isn’t just for spending—it’s for saving and giving as well.” (Read: How can I avoid money tantrums?)

Teaching toddlers and young kids about the value of money

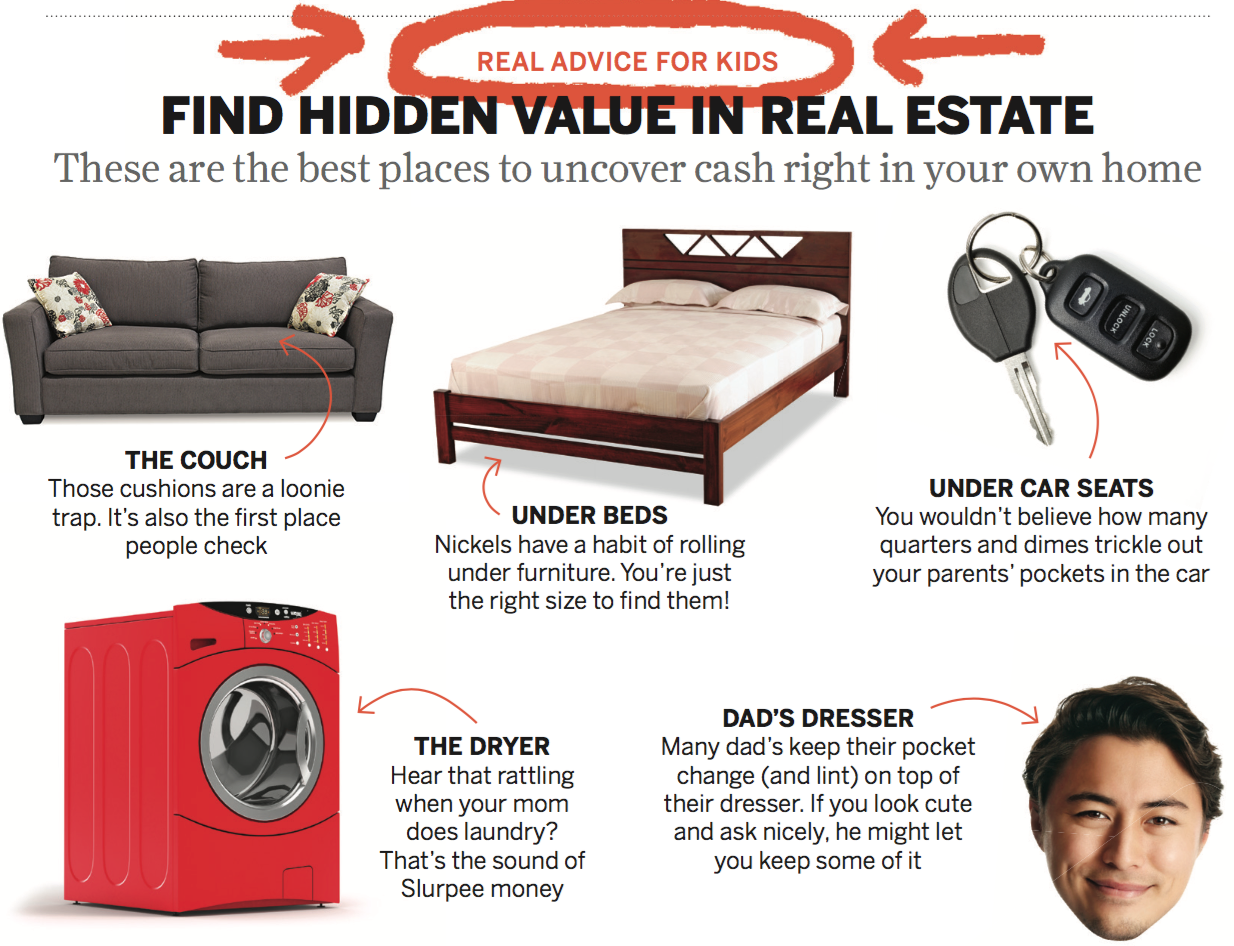

To get kids comfortable with handling money, one of the easiest things you can do is encourage them to sort coins. Help them separate and count out a pocketful of dimes and nickels and show them how many of each add up to a dollar. Give them a clear bin or mason jar to collect their money, so they can watch their money grow. To help them along, Kelley Keehn, author of The Prosperity Factor for Kids, recommends bringing money talks into everyday life. “If you’re in the doctor’s office waiting room, bring out some coins and bills and look for hidden things in the money. These are key learning moments for kids.” (Should you pay your kids to volunteer?)

When you’re ready, start giving them small amounts of money weekly as an allowance; they need to have money in order to learn to manage it. “We gave our three kids an allowance starting when they were toddlers,” says Van Nest, “and we asked them to save 50% and spend 50%.” As they get older, you can introduce the concept of giving, letting the kids decide how much they intend to save, spend and share.

MoneySense columnist Bruce Sellery says he gives his six-year-old daughter Abby an allowance—he says about $5 to $10 a week is appropriate for that age. “It’s key for her to learn from her own money mistakes —and that works for our family,” says Sellery, adding that the allowance is paid regardless of whether she helps around the house or not. Financial educators generally like this approach, and so did a lot of you. In a survey of more than 200 MoneySense readers, 48% agreed that allowance should not be tied to the completion of chores. As one reader noted, “everyone needs to contribute to household chores, no payments required.” (How to explain basic budgeting to kids.)

Don’t forget they’re watching you all the time. “Learn to be consistent as a couple. Get on the same page and write up general rules,” says Kira Vermond, author of The Secret Life of Money: A Kid’s Guide to Cash. “It will help you model the right behaviours to teach them good financial habits.” And if they make mistakes? “Don’t worry—it’s a key part of the process.”

Best savings accounts in Canada

Find the best and most up-to-date savings rates in Canada using our comparison tool

Checklist

Here are smart money moves you can show your kid right now:

❏ Give them a piggy bank

A clear plastic bin where your child can watch his money grow is ideal.

❏ Set a weekly allowance

Nothing too wild: Their age plus $5 should give them something to spend (and save).

❏ Set some limits

Be clear about requirements—if your child is expected to do chores, on which day allowance will be paid and whether they can spend it however they like.

❏ Practice waiting

No money required. Offer your toddler a cookie now or two if she can wait 10 minutes. Learning to delay gratification is a key money skill.

❏ Play store

Have your child put coins into different piles. Count out five nickels and ask them for a quarter. Explain what a quarter is worth and how many make a dollar.

❏ Let them choose the cereal

Use a trip to the grocery store as a teachable moment. Let them choose between two cereals. Which one costs less? But is it also smaller? Help your child reason it out themselves.

❏ Set a long-term goal

Is there a big toy he’d like to save up for? Help by setting some guidelines: Save 50% of your allowance for spending now and 50% for a bigger item later.

Get free MoneySense financial tips, news & advice in your inbox.

More tips on raising money-wise kids:

Ages 7 to 12: Saving not spending »

Ages 13 to 17: Big kids, bigger budget »

Ages 18+: Preparing to launch »

Read more from our student money guide:

Spending and saving for adolescent kids How to educate teens about money What to look for in a kids’ bank account How much money does the government contribute to an RESP?The post Ages 0 to 6: Teaching kids and toddlers about money appeared first on MoneySense.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·