According to Sherpa, understanding whether you’re trading an active or inactive coin is crucial for strategy.

Active trades involve tokens that are trending, highly volatile, and showing strong momentum in either direction. For example, HYPE fits this category—it is expanding rapidly and offers fertile ground for high-leverage strategies.

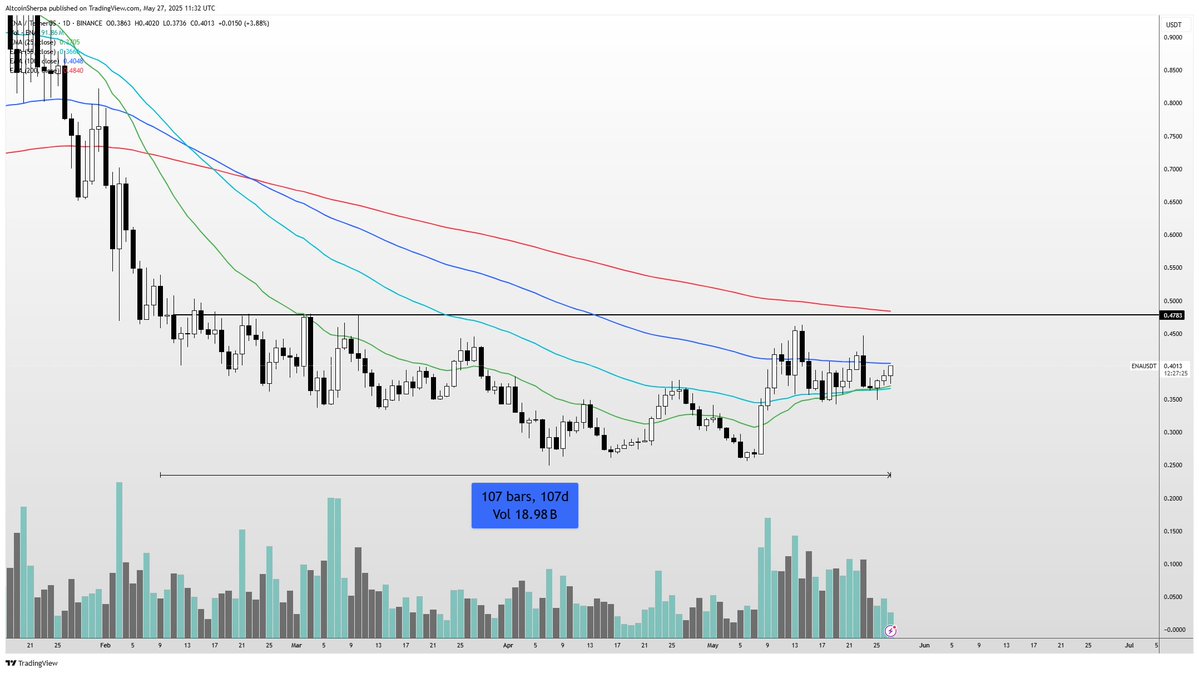

Inactive coins, on the other hand, are consolidating, ranging, or accumulating with no clear trend. ENA, in Sherpa’s view, is a prime example. It’s not moving much and doesn’t offer immediate opportunities for traders seeking fast gains.

Why ENA Isn’t Ideal for High Leverage Right Now

Sherpa cautioned against using high leverage on ENA at its current levels. He explained that going 20x long on ENA right now would likely just tie up capital with little return in the short term.

Instead, he suggested that ENA is a better fit for spot buyers who are betting on the coin’s long-term fundamentals and waiting for a broader narrative to develop and trigger a breakout.

Sherpa summarized the approach by saying he prefers to use leverage on assets that are already moving. Meanwhile, coins like ENA are better suited for those looking to enter early on strong fundamentals and wait patiently for a breakout.

In essence, Sherpa emphasized aligning trading tactics with market conditions—leverage for volatile coins, patience for consolidating ones.

The post Active vs. Inactive Trades: Analyst Highlights Smart Strategies appeared first on Coindoo.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·