Profile

I am forty years old, an occasional digital event producer and freelance stage manager. I work as a TA and an adjunct. I also work a variety of side hustles and am a full-time student working on a PhD in Drama.

Spending & Saving

This month started pretty calmly. Two weeks were spring break for the students at my university, so I got to skip trips into London. The nicer weather is also starting to cut down on Ubers. I don’t really have it in me to get up even earlier than 6:30 am to walk to the train but I do increasingly walk home. And while the travel has been calmer, school deadlines and grading deadlines have all converged, as usually happens in the spring and I have been crazy busy with those things. The last two weeks of the month picked up again with the students going into their spring performance festival, which is a lot of work but actually kind of fun. I like using the industry part of my brain for a few weeks.

In other news, our council tax was recalculated for the upcoming year and, shockingly, went down £10 a month.

I have apparently developed seasonal allergies which include my eyes swelling shut, which is… wild and horrible and wtf body, but here we are. Trying to navigate them for the first time ever included both an uptick in buying several medications to try to find something that works and also part of the toiletries uptick to try to find some kind of moisturizer/lotion to sooth the incredibly dry skin which is part the ongoing psoriasis battle and part extra inflamed due to the allergies. I also had a different kind of reaction I think to my make-up, which, to be fair… I do technically understand makeup kind of goes bad and I have gotten away with a long run of never caring about that. But after my face broke out in hives the day after we went to a wedding and I wore makeup for the first time in… months. And a lot of makeup for the first time since whenever I last went to a wedding… and I realized that my favorite lipstick was a party favor gift from my cousin’s bachelorette party almost 8 years ago… all of this combined to really jack up toiletries, which also includes makeup, because I threw out most of what I had and replaced it.

However, being sort of sick for several weeks also certainly kept the spending pretty reasonable. Though spending so many days trapped in the house did result in me finally tackling several projects – like getting cushions for our incredibly uncomfortable dining room table chairs and a table for the garden to use by the hammock. I know, we live wildly over here.

Next month I suspect a pretty big spend for the main tour and plane tickets for our Egypt trip, and possibly the beginning of spending to book some thing for the summer with the BFF. Other exciting things in May include taking my driving test and heading home for a visit at the end of the month. This winter has felt very long and very slow but I knew the summer was going to fly by in a mix of exciting travel adventures and knowing that my thesis is due in September.

So that’s life these days.

Expenses this month:

Rent – $833.93 Food – $449.06 Egypt – $265.43 Trains – $168.69 Gifts – $164.35 Utilities – $156.85 House – $147.74 Toiletries – $110.48 Entertainment – $83.57 Council Tax – $76.06 TfL – $61.13 Ubers – $54.57 Charity – $42.70 Blog – $37.00 Medicine – $34.46 Taxes – $14.99Total Spending in April: $2701.01

Hustling

This month’s income:

Tax Refund – $3927.00 Adjuncting – $1866.52 Teaching Assistant – $728.80 Dividends – $43.20Income This Month: $5,836.72

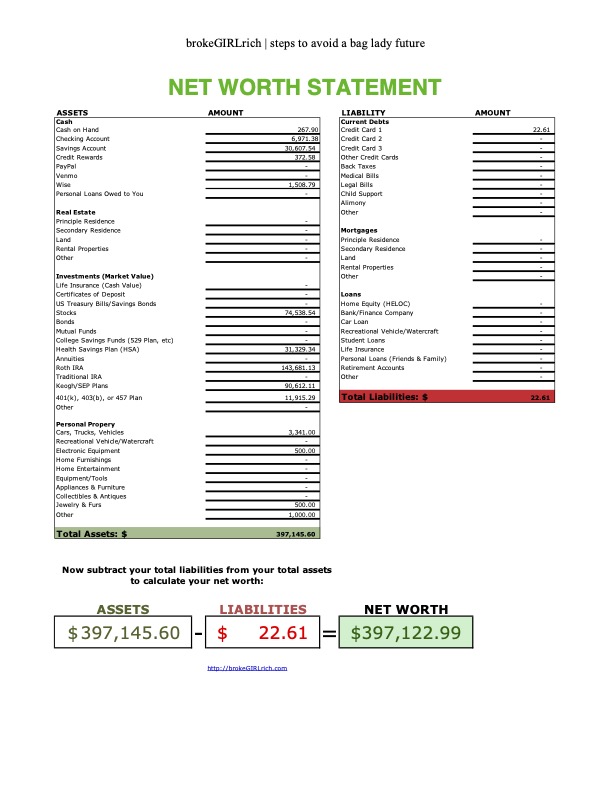

Net Worth: April 2025

Goals

Onwards to the goals!

Max Out My Roth IRA for 2024:Done. Max Out My Roth IRA for 2025: $7000 to go. Max Out My HSA– $4300 to go. Go to Egypt with My Boyfriend and Family: Aiming for $3000 saved (though I hope it will be closer to $2500). Boom. Done. And hopefully I will come in under budget (I think I’ve actually got it down closer to $2000 – which means some of this will be able to roll over to the BFF viist). Best Friend Summer Adventures:My BFF visits every summer for like two weeks and we usually explore an area of the UK for a long weekend and fly to somewhere with a cheap plane ticket for a long weekend. Unless the digital producing really picks up, I may need to dip into the savings to do this, but I’m aiming to save between $2000 and $3000 for her visit. Sunshine Getaway – This is officially pushed to the fall. We are aiming for some sunshine and cocktails over a long weekend to the cheapest decent all-inclusive we can find in Europe the week after my doctoral defense – whenever that winds up being scheduled. Save $1,200 for my US Car Insurance by June Buy a Used Car in the UK– I currently have $10,000 in a new car account because my Toyota Matrix is on her last legs. I was saving to purchase a new car, but instead I’m looking to buy a used car in the UK after I finish my driving lessons for approximately £5,000 or less. Pay for a Graduate Visa– this is going to cost around £4000 and I have $6000 left in my tuition account, so this should be good to go. We will see at the end of the year.The post Accountability: April 2025 appeared first on brokeGIRLrich.

.jpg.webp?itok=1zl_MpKg)

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·