“I used to read Mr. Money Mustache”,

some people say these days,

“Until he got all rich and fancy so that he no longer understands the common person’s plight.

Stash probably doesn’t even practice any of these money-saving things he preaches any more!”

When I read things like this, I can’t help but laugh. Because on the one hand, when you put a bunch of personal life details online like this, being misunderstood is just part of the package. But on the other hand, if the critics could peek in and see our real lives – not just mine but those of all the Mustachians – they would have to give up their conspiracy theories and accept the fact that this stuff just works.

Because really, not much has changed when it comes to the basics. Like many MMM readers over the past twelve years, my total wealth level has increased pretty regularly. But also like many of us, I haven’t felt the need to change very much about my spending because I was doing my best to live an enjoyable life in the first place.

How have so many people found such great success? I think we Mustachians have something that’s a bit more rare and special than standard financial advice, which is what makes it work so well:

Standard Advice:

Slash your spending and make sacrifices until you reach a certain savings percentage, and beyond that it doesn’t matter, it’s all personal choice. More income? Great, that means you don’t have to sacrifice as much! FatFIRE for everyone!

Mustachianism:

Cultivate a love of efficiency, creativity, self awareness, and self improvement. Use this knowledge to improve your life in all ways, including those which help you live better even as your monthly expense rate drops over time.

So what does this mean in practice?

Well, I’ll give you some examples from my own present-day life. Things I do because I happen to enjoy them, which also happen to save a lot of money. Some of these are normal, some are silly and may end up in some future gossip magazine hit piece, but all of them happen to work for me, so the critics can be damned.

As I list each item, I’ll include an estimate of how much the activity saves me per decade, because you should always think at least in terms of decades.

To make that calculation yourself, just use the “rule of 172” – take a monthly expense and multiply it by 172 to estimate how much it would compound into over ten years, if invested.

1) Fixing my own House (and everybody else’s too)

Construction projects from recent years, at home and around the state.

Construction projects from recent years, at home and around the state.

I’m a big believer in self-sufficiency, and working to build up the skills to manage the most important parts of your own life without depending on too many things (or people) that are outside of your control. In other words, one giant recipe for a happy life is simply to Become a Producer of the Things You Most Enjoy Consuming.

And in my case, I happen to love houses. I like living in beautiful, functional spaces and sharing them with friends. But most houses are ugly and poorly designed when you buy them, so I realized that I also love solving problems and redesigning old buildings to become new again. I enjoy this process so much that I spend most of my free time doing it – on both my own properties and the homes of friends.

And I love teaching other people to gain power over their own houses too. It’s amazing how great people feel as they lose their fear and dependence on outside contractors, and gain the ability to fix and maintain things with their own two hands.

Savings: An average of $20,000 per year = $287,000 per decade

2) Craigslist and Community

You know what’s great? Having so much money that you can buy whatever you want – high quality things which get delivered to your front door the very next day.

You know what’s even better? Not buying some of those new things, and instead finding ways to share, repurpose and buy equally high quality items from other people who don’t need them any more. All while building up your own community and creating new friendships in the process.

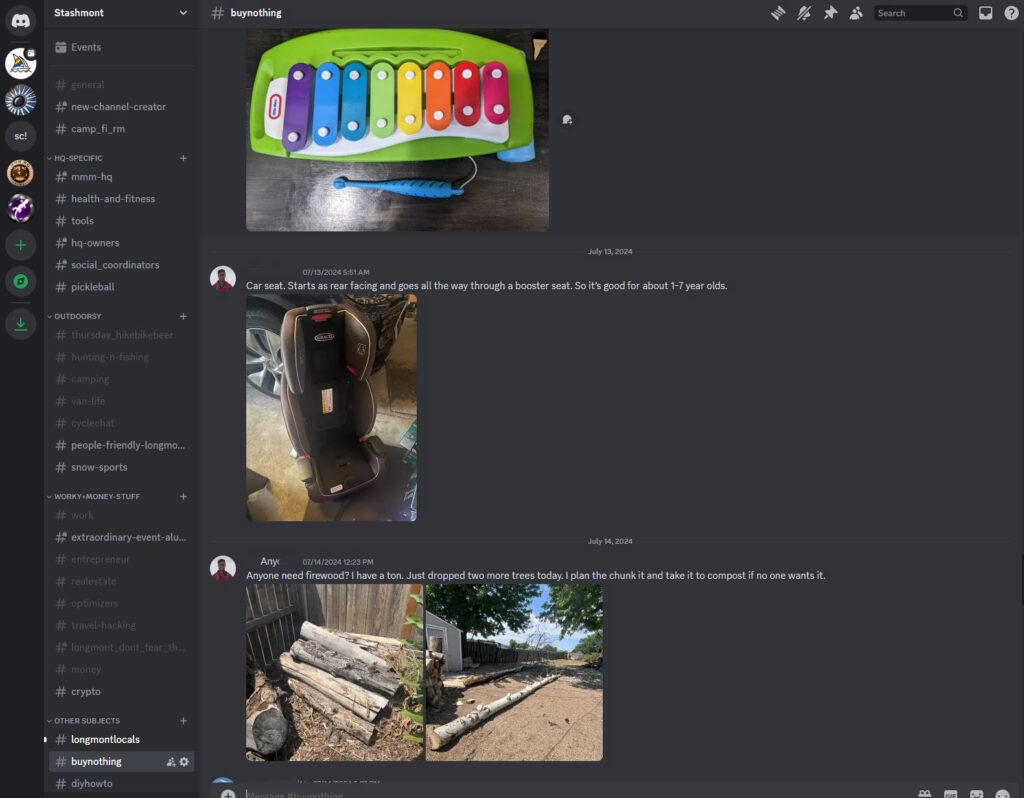

Craigslist, Facebook Marketplace, and even NextDoor all have Buy Nothing groups for most areas. In the MMM-HQ community, we run a Discord server with about 200 local people, who chat around the clock on a wide range of subjects. They help each other with major projects in one channel called #diyhowto, and give away and sell things on #forsale and #buynothing.

Although our private Discord group is my favorite, I also use Craigslist regularly, and probably save (and earn) a few thousand every year thanks to the habit:

Savings: About $42,000 per decade

3) Bikes over Cars

We all know that Mr. Money Mustache’s biggest contribution to personal finance is to insist that bike transportation is the best way to get around. And I still feel this way. As we learned in The True Cost of Commuting, cars cost at least 50 cents per mile to operate, while bikes are much cheaper, mainly due to reduced depreciation and maintenance costs (which are even bigger than the gas savings).

I do still use bikes (or walking) for at least 95% of my local trips these days, but because I live in the center of a small city, my life is pretty local. So this still only adds up to about 2000 miles per year, a savings of “only” $14,000 per decade.

But when you choose active transportation, there’s much more to the picture than just cutting your car expenses. You’re changing everything about your physical and mental health picture for the better, which brings us to the next point of…

4) Muscle over Motor

Digging out the crappy old window wells to build a bigger terraced garden.

Digging out the crappy old window wells to build a bigger terraced garden.Although I’m no competitive athlete, whenever I see an option to make my body work a bit harder, I usually take it. Stairs instead of elevators, running the golf course instead of using a golf cart, moving my own furniture and appliances instead of calling a mover, shoveling snow and raking leaves instead of using a machine.

When I face a decision like this, I simply ask myself the question:

“Well, Mustache. Do you want MORE health and fitness, or LESS?”

Putting it in that context makes the answer obvious. Every bit helps, because when it comes to your body, the rule is pretty much use it or lose it.

But how much money does this save? There’s no real way to calculate it exactly, but I like to think of it this way: The US average health care spending is about $13,000 per person per year. My lifetime costs due to illness or medication so far have been just about zero, plus I know I’ve had more energy and greater productivity due to being healthy. Let’s just put it very conservatively and set the estimated savings and benefits at $10k per year which means

Estimated Savings: $140,000 per decade.

5) Saving Energy by Running my home like a Glamping Retreat

Here’s where things get a bit silly, but my level of joy is actually at its greatest.

My personality type is probably a weird combination of an engineer, a carpenter, an artsy hippie, and a mad scientist. Oh, and a devoted homebody too. Because of this, my favorite activity most days is to just run around my house taking care of things and trying new little experiments and improvements.

Sometimes I’ll cut a few big holes on on the South side of the house and install sliding doors and big windows to allow nice sunbeams and passive solar energy to get into my house and give me free heat in the winters. Other times it’s just smaller things to save energy and live more at at one with the seasons of my area:

optimizing the use of air conditioning by running fans at night and building heat tolerance during the days (we set the A/C to only kick on at about 80F)Enjoying most of my showers outside, with free hot water from the 100 foot garden hose that happens to be coiled in a sunny spot

Cooling myself and get free energy boosts by jumping in the “cold plunge”, which is simply an unheated hot tub I have set up in my back yard

Doing most of my cooking and dining outdoors with an induction cooktop, gas grill, espresso machine, and mini convection toaster oven deal that I keep set up outside during the warmer months of the year

Drying 99% of my loads of laundry out on the line instead of using the clothes dryer

I even charge my car with a little off-grid array of solar panels set up in the driveway (from Craisglist, of course!), which gives me free electricity for driving without going through the permit-hell hassle of a full grid-tied system in my city’s currently solar unfriendly environment.

Even taken all together, these things are pretty small – the average combined gas and electric bill for my area is about $250 per month, while my usage adds up to about $75. So while we’re only saving about $30,000 per decade for what sounds like a lot of work to most people, I consider this to be the biggest win because I enjoy living in “MMM’s Energy Efficiency Playground” so much.

6) Local Living over Constant Travel

This little lake right behind my house is a great daily “vacation” which allows me to savor home life more and travel a bit less.

This little lake right behind my house is a great daily “vacation” which allows me to savor home life more and travel a bit less.“Hey, we’re having a big back yard pool party next weekend to celebrate Amy’s graduation from kindergarten, can you make it?”

“OH NOOOO!!! We will be off in at Disneyland that whole week! We planned the trip months ago, I wish we could make it!

As I type this in the height of the summer season, I really feel this effect at its fullest: almost all of my friends are off on trips, and my guest suite here at home is almost constantly full. People are traveling a lot, and many of them sound like they wish they could spend a few more of their precious summer weeks and weekends at home.

I’ll let you in on a little secret: you can! The trick is saying, “no thanks” more often to plans that involve you being away, and “yes please” to things that let you stay at home. The benefits are numerous:

You nurture your local friendships more and meet new people who live nearby You spend way less money on plane tickets, hotels, restaurants gasoline, and car repairs Your levels of health and fitness can go way up because you aren’t missing workouts and spending hours sitting in plane and car and bus seats. And you can better control your meals – more salads with grilled salmon, less McDonald’s and Pizza Hut You sleep better And you have more time to take care of projects around your house where you learn more skills which compound for lifeEstimated Savings: Even if you replace just two weeks of travel for a family of four, with equivalent time at home you might save $5,000 per year in direct costs and a further $5,000 per year in incidental benefits like the health and local friendships. This would work out to a shocking $143,000 per decade of wealth increase!

Of course, travel is generally a good thing for broadening the life experience of you and your kids. It’s worth spending on, lavishly at times. But the key is to balance it out and be discerning, keeping the most enriching trips and pruning a few off the bottom of the list. And remembering that home time is valuable and healthy too.

And Whoa! We’ve already built up a huge list and I feel like I was just getting started.

Taken all together, we’ve already detailed things that compound to $656,000 every decade, which already more than double the median wealth that most American seniors have as they cruise nervously into their retirement years – after over 40 years of work!

And now that I’ve been writing this blog for over ten years myself, I can safely say that over $656,000 of even my most recent worth increases are directly attributable to these simple habits. The same ones many of us have been enjoying and preaching about all along, both before and after our retirement dates.

If money is in genuinely short supply, you could go a lot further than the examples in this article. And indeed, there’s a lot more laid out in this blog or the MMM Boot Camp email series.

But one of the points of Mustachianism is that you usually don’t have to try all that hard. Just tweaking your lifestyle to be slightly less ridiculous and more efficient than average is usually all it takes.

—

In the comments: what are your quirks and frugal indulgences? The things you do now to save money, or things you still do even after it’s no longer about the money? I often wonder how widespread this frugality-just-for-fun is. But since we Humans are a naturally curious and problem solving species in our natural state, I suspect there are many more of us out there.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·