Key Takeaways:

Strategy acquires 13,390 BTC for $1.34B, pushing average buy price close to $100K. BTC yield hits 15.5% YTD, prompting Strategy to raise its 2025 target to 25%. Critics warn of potential downside risks amid soaring leverage and record-high entry points.Michael Saylor’s Strategy continues its aggressive Bitcoin accumulation with a $1.34 billion purchase last week, coinciding with BTC briefly topping $100,000. This strategic buy brought the firm’s total holdings to an eye-popping 568,840 BTC. While the move signals confidence in long-term value, market critics are sounding alarms about the risks of such concentrated exposure.

Read More: Strategy Plans $21 Billion Bitcoin Buy with New Stock Offer

Strategy Makes Landmark Purchase as BTC Crosses $100K

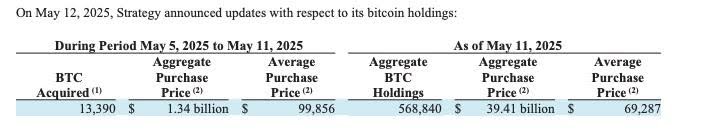

Between May 5 and May 11, Strategy acquired 13,390 BTC at an average price of $99,856 per coin, as disclosed in a recent SEC filing. This latest acquisition marks one of the company’s most expensive BTC entries to date and raises its cumulative Bitcoin holdings to 568,840 BTC—valued at approximately $39.41 billion, with an average cost basis of $69,287.

The purchase occurred as Bitcoin reclaimed and temporarily held the $100,000 level for the first time in history on May 8, driven by a mix of institutional demand, supply constraints, and increasing interest from sovereign wealth funds.

The announcement came directly from Michael Saylor, Strategy’s co-founder and Executive Chairman, who posted the news on X (formerly Twitter), sparking widespread discussion in the crypto community and traditional finance sectors alike.

Strategy has acquired 13,390 BTC for ~$1.34 billion at ~$99,856 per bitcoin and has achieved BTC Yield of 15.5% YTD 2025. As of 5/11/2025, we hodl 568,840 $BTC acquired for ~$39.41 billion at ~$69,287 per bitcoin. $MSTR $STRK $STRF https://t.co/oSXRMwiTkU

— Michael Saylor (@saylor) May 12, 2025

Read more: Michael Saylor Calls on U.S. Government to Purchase 25% of BTC Supply

Yield Surpasses 15.5%, 2025 Target Raised to 25%

Following the $1.34B acquisition, Strategy achieved a 15.5% Bitcoin yield YTD for 2025—a performance metric that reflects the ratio of BTC holdings to diluted shares and capital input. The firm had originally set a 15% yield target for the full year but has now raised its ambition to 25%.

This sharp upward revision suggests continued bullish sentiment inside the company, even at elevated market prices. Last year, Strategy posted a staggering 74% BTC yield, and it seems determined to maintain high performance in 2025, despite increased volatility.

What Is BTC Yield and Why Does It Matter?

The term “BTC yield” as used by Strategy is a proprietary metric reflecting the increase in Bitcoin holdings relative to total equity or share dilution. While not a conventional financial metric, it’s become a key internal benchmark for Strategy’s aggressive Bitcoin strategy. Achieving 15.5% YTD implies that their acquisition pace and BTC performance have outpaced shareholder dilution, maintaining value per share.

Critics Raise Red Flags Over Price and Leverage

Not everyone is applauding the strategy. Peter Schiff, a long-time gold advocate and prominent Bitcoin critic, responded to Saylor’s announcement with a stark warning. Posting on X, Schiff said:

“Your next buy will likely push your average cost above $70,000. The next leg down in Bitcoin will likely push the market price below your average cost. Not good considering how much you borrowed to buy the Bitcoin.”

His criticism targets Strategy’s extensive use of debt and equity to fund Bitcoin acquisitions. According to filings earlier this month, the firm doubled its planned capital raise to $84 billion—split between equity and fixed-income offerings—to maintain its BTC-buying strategy. That level of leverage, Schiff argues, could lead to significant realized losses if the market turns south.

Market Outlook: A Balancing Act Between Confidence and Risk

The crypto community remains divided. While Bitcoin’s rally above $100,000 has fueled renewed excitement and institutional FOMO, analysts warn that rising average entry prices for mega-holders like Strategy introduce greater downside risk. If Bitcoin retreats to previous support levels in the $80,000–$90,000 range, it could test the profitability of recent high-level buys.

Still, Strategy’s unwavering accumulation strategy sends a strong signal to the market: they are betting on Bitcoin not just as a store of value but as a core corporate treasury asset for the long haul.

Some analysts, including Galaxy Digital and Bernstein, view the move as consistent with broader institutional trends. They highlight that ETF inflows remain steady and miner selling has slowed post-halving, further tightening supply in the short term.

Strategy vs. The Field: A Growing Divide

While Strategy continues to lead the charge, other crypto-native firms appear less eager to follow suit. A Bloomberg report earlier this year revealed that Coinbase, despite exploring a similar Bitcoin accumulation strategy, ultimately decided against it, citing operational risks and balance sheet volatility.

As BTC prices soar, corporate strategies are diverging. Some firms prefer diversified treasury allocations or tokenized real-world assets, while Strategy doubles down on Bitcoin alone.

Final Thoughts

The latest $1.34 billion BTC purchase cements Strategy’s position as the largest corporate Bitcoin holder by far. But the real question is whether this bold, debt-fueled accumulation model can withstand the next correction. With an average acquisition cost nearing $70K and leverage climbing, the stakes have never been higher—for Strategy, and for the broader market that follows its lead.

The post $1.34B Bitcoin Buy Sends Shockwaves as Strategy Nears $40B BTC Holdings—Is a Pullback Coming? appeared first on CryptoNinjas.

Bengali (Bangladesh) ·

Bengali (Bangladesh) ·  English (United States) ·

English (United States) ·